GILBERT ESTATE PLANNING LAWYERS

ESTATE PLANNING ATTORNEYS IN GILBERT, AZ

ESTATE PLANS

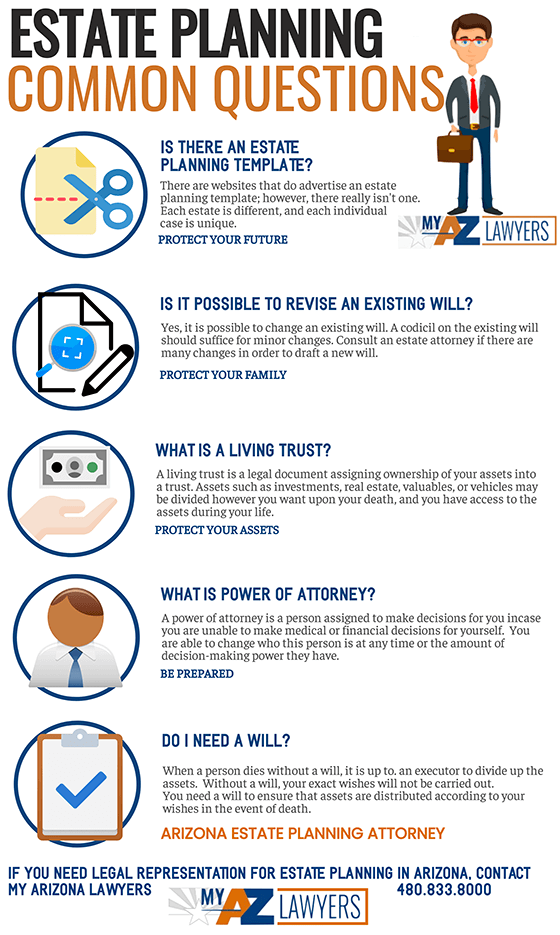

Do I Really Need an Estate Plan in Gilbert, Arizona?

Yes, you probably do! Anyone who is of sound mind and over the age of 18 can create an estate plan in Arizona. Estate plans aren’t just for the rich- if you own any type of property, or want to deal with medical issues in advance should you ever lose legal capacity, you should create an estate plan. You don’t need to wait until you’re older- emergencies and accidents can happen at any time, so it’s always better to be prepared.

Your estate plan does so much more than list who gets what after you die. Additionally, you can use your will to choose your estate executor and a legal guardian for your children. Plus, you can use trusts to help pay for your family’s specific needs, like medical care for a disabled relative or your children’s college expenses. Also, you can use a living will to let doctors know whether you’d like to be kept on life support, be resuscitated, receive treatments like drugs and dialysis, and more. You can use a power of attorney to give someone trustworthy the authority to complete important transactions on your behalf. You should use some combination of these documents to create the ideal estate plan for your situation.

When Should I Change My Estate Plan?

Once you create an estate plan, you can change it as long as you are of sound mind and execute the changes properly. There are several types of events that could make you want to change your estate plan. Many people need to make changes after the birth or adoption of a new child into the family, and after a marriage or divorce. You may also need to change your estate plan after becoming estranged from a friend or family member. Depending on the estate plan you have created, you will either need to amend your will through a codicil, or revoke your estate plan and start over with an entirely new one.

Estate Planning Instrument Options

There are several types of documents you can use to create your estate plan in Gilbert. Each serves different purposes, and offers different benefits and disadvantages. You will probably need to combine at least a few of the following types of documents to create your ideal estate plan:

-

Will: If you’re only going to create one document for your estate plan (which we don’t recommend), it should be your last will and testament. A will is the most commonly used instrument to distribute assets when you pass away. However, besides leaving assets for your beneficiaries, a will has two other important functions. One of them is naming a legal guardian for your children should you pass away before they reach adulthood. The other is choosing the executor of your estate.

-

Trusts: Trusts provide an opportunity to help beneficiaries avoid taxes and probate court, which also protects their privacy. Trusts can also be used to leave money and assets to your beneficiaries for a specific purpose, such as medical treatment or higher education. There are several other options you will have when creating trusts for your estate plan, including whether the trust should be revocable or irrevocable. If you plan on using trusts in your estate plan, it’s best to do so with the assistance of a knowledgeable estate planning lawyer.

-

Power of Attorney: If you fall into a coma, experience a severe traumatic brain injury, or develop a degenerative cognitive disease, your doctors and family members might have to guess how you would like certain issues to be handled. Therefore, a power of attorney gives your agent or personal representative the authority to make decisions and complete transactions on your behalf. Plus, it can be limited in scope and duration, or can be broad and apply to almost every aspect of your life. You can also use a Health Care Power of Attorney to assign who should be in charge specifically of medical treatments if you become legally incapacitated.

-

Advanced Health Care Directives: Instead of giving someone else the authority to make medical decisions on your behalf, you can make them for yourself in advance. The most commonly used advanced health care directive is a living will. This document can be used to instruct doctors in the future about whether you’d like to receive treatments such as CPR, dialysis, life support, and more. Having advanced health care directives in place can eliminate stress and confusion for your family members and doctors if you are ever in this type of situation.

MODIFYING AN ESTATE PLAN

With My AZ Lawyers

Can I Change My Estate Plan Once Created?

The good thing about creating an estate plan is that most of the components of it can be changed as your life and circumstances change. There are innumerable life events that could occur that could make you want to add or remove a beneficiary from your will and the rest of your estate plan. For example, you may welcome a new child into your family, or have a severe falling out with one of your family members. Marriage and divorce are usually good reasons to review your estate plan. Many people also create or change their estate plans after someone they love develops a disability or medical condition that requires lifelong care. You may also want to review your estate plan after acquiring a large asset, such as a house. Staying up to date with your estate plan will make sure that your loved ones get the most out of your estate with as few costs and inconveniences as possible.

So how exactly should you go about changing your estate plan? Just like almost every other estate planning question, it depends on your specific situation. You will also need to make sure that your changes are made across each of your estate planning documents if you want them to be consistent. The laws in your state could change in a way that might require you to change your estate plan accordingly. No matter the reason, an experienced estate planning lawyer can help you figure out the best way to amend your estate plan to meet your needs

AMENDING AN ESTATE PLAN

Amending your estate plan, no matter the reason, requires an experienced estate planning lawyer in order to help you determine the best action to meet your needs As described below, there are different legal strategies to best change your estate. Depending on if your estate plan is fairly straightforward or if it is a bit more complex, our legal team will ensure that an update to your estate plan to meet the needs of you specific and unique situation. Contact My AZ Lawyers Gilbert Estate Planning Attorney for a free consultation to discuss legal assistance if you wish to change or create an estate plan.

Codicils

If you already have an estate plan that is fairly straightforward, you may be able to modify your estate plan through the use of one or more codicils. A codicil can change or supplement your will, trusts, etc. While Arizona will recognize a holographic, or handwritten, codicil, it’s better to go about it through the clearest means possible. Failure to meet Arizona’s material provision requirements could end up with the codicil being tossed out in probate court. Having witnesses at the signing will increase your codicil’s strength in court, as well as having the codicil notarized.

Revocation

If your estate plan is complex, it may be impossible to make your desired changes through codicils. In these types of situations, it can be easier to simply revoke your estate plan and start over with a new one. There are multiple ways to revoke, or cancel, your estate plan in Arizona. One way is by destroying your will or other estate planning instrument you wish to revoke. There is no specific way you need to destroy your will- you can burn it, tear it, shred it, as long as you make it clear that you mean for it to be destroyed. Even if someone manages to piece together the burnt tatters of your revoked will, the court will uphold the revocation as long as it is clear that you intended to revoke it. But this leaves you with the issue of not having one or more parts of your estate plan in place. You should create a new document to replace the one you destroyed as soon as possible. You should also alert anyone who knew of the document that was revoked of your new intentions so that there isn’t any confusion after you pass away.

Another way to revoke your will and other parts of your estate plan is by creating a new, inconsistent document to replace it. The terms of your new document must be materially inconsistent from the original document. If you use this method, your most recently created document will be the one the court uses after you pass away. But multiple wills, trusts, and other estate planning instruments that need to be sorted by date can be confusing for your family members. In your new document, you should include a provision that this document is meant to replace a previous one, with any descriptors necessary. If you’re looking to update your estate plan, don’t take any risks. Discuss your situation with one of our experienced Gilbert estate planning lawyers. We offer affordable rates and your initial consultation is free of charge.

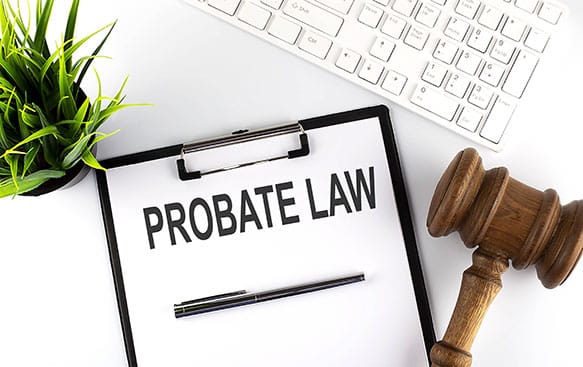

PROBATE

Probate and Estate Planning

While planning your estate, you’ll hear time and time again about the goal of helping your estate avoid probate after your death. You may be wondering just why it is so desirable to avoid the probate process. Estate planning lawyers at My AZ Lawyers will help you find creative way to avoid probate because of its disadvantages.

Estate planning lawyers will help you find a creative way to avoid probate because of the disadvantages it offers:

-

It takes a long time: You can usually expect the probate process to take up to 6 months, and even longer for larger and more complicated estates. Court delays, executor procrastination, challenges to your will, and other factors can also extend the probate process. So if your family is relying on funds or assets from your estate, probate can put them in a bind until completed.

-

It’s a lot of responsibility for your executor: A vital part of moving an estate through probate is assigning an executor. If you haven’t designated one in your will, it will be the court’s responsibility to pick one for you. In some cases, your estate’s executor could end up being a complete stranger, or even one of your creditors. Therefore, you will want to be sure to pick someone who is responsible and stays on top deadlines to be your estate’s executor. However, you may not have anyone in mind, or may not want to burden them with all the responsibilities that come with being an executor. Additionally, your executor can charge a reasonable rate to work on moving your estate through probate and then distributing it amongst your beneficiaries, which can eat away at your estate’s total value.

-

It can be stressful: The last thing you probably want is for your family to spend months or even years fighting over your last wishes in court after you pass away. Typos and miscommunications can result in your estate being distributed drastically differently than you intended.

-

It can be expensive: When someone disputes your will or challenges any other part of your estate plan, it won’t just hurt your family by causing emotional turmoil. Unless they are knowledgeable about Arizona estate and probate laws, they will probably need to hire a probate lawyer to represent them in any disputes. Probate lawyers charge by the hour, so the more hiccups there are in the probate process, the more it will cost your loved ones. There will also be additional costs like court fees and process server fees.

-

It compromises privacy: When assets are passed down through a will, and go through the probate process, it becomes a matter of public record. Some issues may even need to be hashed out in a courtroom, in front of a judge, attorneys, and other people you and your family don’t know. Gifts, trusts, and other forms of transfer can help protect your family’s privacy.

With all of these downsides, it’s no wonder that so many people aim to minimize or avoid probate entirely when planning their estates. But the default in Arizona is that every estate should go through probate. However, estates under certain values can skip the probate process using a small estate affidavit. The limits for a small estate affidavit in Arizona are $75,000 in personal property and $100,000 in real property. Real property is another term for real estate when it comes to estate planning. Personal property refers to just about every other type of property.

While $75,000 and $100,000 might sound like high numbers at first glance, your estate could actually easily exceed Arizona’s small estate limits. If you own your home, you will want to start by checking how much equity you currently have. Vehicles, bank accounts, stocks and bonds, and antiques and collectibles can quickly add up to reach Arizona’s personal property limit for small estates. Depending on how your estate is composed, there may be some flexibility to help you qualify for a small estate affidavit in Arizona.

An experienced financial advisor may be able to help you determine the total value of your estate. Plus, you can also discuss your estate with an estate planning lawyer, who should be able to help you estimate your estate’s value. Our experienced Gilbert Estate Planning Lawyers offer free consults and affordable rates.

Strategies to keep your estate within arizona’s limitations

With My AZ Lawyers

Is your estate just on the edge of meeting Arizona’s small estate affidavit requirements? Do you have little need for some of your assets, or already know who you want to have them? Do you have family members you can trust to not abuse access to your assets before you pass away? You may be able to utilize some estate planning strategies to qualify for an affidavit.

Give loved ones assets as gifts while you are still alive: A simple way to make sure your estate qualifies for a small estate affidavit is by reducing its size while you are still alive. If you’re using this strategy, you will probably want to avoid gift taxes in the process. Arizona is a state that doesn’t have a gift tax, but you still need to keep federal gift taxes in mind. The yearly limit before federal gift taxes are triggered is $15,000 per recipient.

Name your loved one as the recipient on a payable on death (POD) account: The concept of payable on death accounts is pretty self-explanatory. You will list a loved one to receive the account upon your death, and if you wish, an alternate recipient. The contents of a POD account will transfer immediately to the recipient once your bank has been alerted of your death (which usually means providing them with your death certificate). Because the account has already been transferred to the beneficiary, its value won’t count towards your estate’s total value for small estate affidavit purposes.

Transfer your money and assets to loved ones through trusts: Trusts can reduce your estate’s value to avoid probate, and offer many other benefits to those who use them in their estate plans. They can help maintain your estate’s value by avoiding certain types of taxes. You can also specify exactly how you would like the assets in your trusts to be used. For example, you can create a trust that can only be used for your grandchildren’s college education, or that is meant to care for your wife’s home care and other medical treatments. Or, you can create a trust that will only transfer when a certain condition is met, such as when your child turns 30 or gets married.

Change the title of your property to a joint tenancy with right of survivorship: If one of your family members is a joint owner of your property, that asset won’t need to go through probate for your family member to continue using it after you pass away. Because Arizona is a community property state, you can also hold property together with rights of survivorship to avoid probate.

Contact My AZ Lawyers experienced estate planning legal team in order to discuss your specific legal needs regarding an estate plan. Protecting your future is a priority, and our law firm offers a free consultation. Call us to schedule and find out why My AZ Lawyers is what Arizona residents expect from a dedicated, professional legal office.

POWERS OF ATTORNEY

Keeping Your Affairs in Order in Unthinkable Circumstances

Another vital aspect of your estate plan is deciding who will keep your affairs in order if you ever lose the ability to make important decisions for yourself. Let’s say you end up in a coma, or are in the late stages of a degenerative cognitive disorder like Alzheimer’s. Paying your bills, running your business, and other similar tasks will become impossible for you to complete on your own. You can use a Power of Attorney to give someone else the authority to complete these types of tasks on your behalf.

You can also give the person you select, your agent or representative, the right to make medical decisions on your behalf, or you can narrow their scope of authority. Our Gilbert estate planning attorneys can help you with all of your Power of Attorney needs- call 480-833-8000 or use our online form to schedule your free consultation.

General Durable Power of Attorney

This type of power of attorney encompasses many types of business and financial responsibilities. You can revoke this power of attorney at any time that you are legally mentally competent. You can also indicate just when you would like a power of attorney to take effect- for example, you could require the medical opinion of one physician, or two or more physicians.

Special Power of Attorney

This type of power of attorney is used when you want to give your agent less authority to act on your behalf. It can be used for a small range of responsibilities, or just one specific transaction. It doesn’t always need to be used in medical emergency situations- many people use them when they will be out of the country or otherwise unavailable to complete a specific transaction.

Health Care Power of Attorney

This type of power of attorney is used solely for decisions regarding your health care and mental health care treatments. This will give your agent the authority to decide on issues like whether you would like to be kept on life support, whether you should donate your organs, and more. You can also use an advanced health care directive to indicate how you would like your agent to decide on these issues.

Revocation of Power of Attorney. Maybe you no longer have a need for your power of attorney, or you want to assign these responsibilities to someone else. If so, you will need to revoke, or cancel, the power of attorney. The person named in your revoked power of attorney will need to be properly notified of the revocation. Doctors, bankers, and anyone else who interacted with the agent should be informed as well.

ADVANCED HEALTH CARE DIRECTIVES

With My AZ Lawyers

LIVING WILL

Eliminate Confusion with a Living Will

As much as you may trust your loved ones, you still may feel strongly about certain medical treatments and would prefer to make those decisions for yourself in advance, should they ever become necessary. You can create a living will to let your family members and doctors know how to proceed in situations where you aren’t able to communicate your wishes yourself.

Here are some of the decisions you can predetermine in your living will:

-

Antibiotic and antiviral medications

-

Organ, tissue, and body donation

-

Dialysis

-

CPR, or cardiopulmonary resuscitation

-

Mechanical ventilation

-

Tube feeding

-

Palliative care

-

Being taken to the hospital

-

Do Not Resuscitate, or DNR

-

Do Not Intubate, or DNI

There may be more specific provisions you can include in your living will based on your medical conditions. You can also use your living will in conjunction with a health care power of attorney. You can discuss your options with a Gilbert estate planning lawyer by calling 480-833-8000.

TRUSTS

Maximize Your Gilbert Estate Using Trusts

Trusts aren’t just for rich people. People from all walks of life can use trusts to help their families with expenses after they pass away. They offer several benefits. Trusts transfer upon the grantor’s death, meaning they don’t need to go through probate. This helps keep costs down, avoid delays, reduce family strife, and protect everyone’s privacy.

Trusts can also help you protect certain assets from your creditors, and decide exactly what your assets should be used for after your death. But you will have many options to choose from when creating trusts for your estate plan. An estate planning attorney can walk you through them so that your loved ones get the most out of your estate.

One of the biggest decisions you will have to make when it comes to trusts is whether you want yours to be revocable or irrevocable. As you may have already guessed, this refers to whether or not your trust can be canceled after it has been created. Our Gilbert estate planning team can help you with this decision, along with creating the rest of your estate plan. Call 480-833-8000 for your free consultation.

Revocable Trusts

This type of trust, also known as a living trust or an inter vivos trust, can be canceled during your lifetime. Assets contributed to the trust will be managed by the trustee until they are transferred to the beneficiary. Beneficiaries, assets, and stipulations can be changed as the grantor sees fit. But this flexibility doesn’t come without its disadvantages. Assets in revocable trusts aren’t protected from creditors. They may also be subject to taxes after the grantor passes away.

Irrevocable Trusts

This type of trust is set in stone once created. The grantor will have no ownership or control over any assets they contribute to an irrevocable trust. They can relieve the grantor of income taxes attached to contributed assets, as well as avoid estate taxes upon the grantor’s passing. They are also protected from seizure by creditors so you can be sure your loved ones will receive them after you die. But mistakes in creating an irrevocable trust will cause permanent inconveniences. Create your trust with an experienced estate planning attorney- call 480-833-8000 to get started.

effective estate planning with affordable pricing

With My AZ Lawyers

Whether you’re looking to create your estate plan or make changes to one already in place, our Gilbert estate planning lawyers are here to help. Our attorneys offer expertise and compassion to help you create the most strategic estate plan possible. We can help you find the perfect combination of a will, trusts, powers of attorney, advanced health care directives, and more. Our rates are affordable and you can pay your fees in a budget-friendly payment plan. Don’t wait until it’s too late to create your estate plan- pick up the phone and call 480-833-8000 to schedule your free consultation