ARIZONA BANKRUPTCY LAW PRACTICE AREAS

CHAPTER 7 BANKRUPTCY

Chapter 7 bankruptcy, also referred to as a “Fresh Start” bankruptcy, provides Arizona residents with a clean financial slate — a new, debt free start. In Arizona, many find it difficult to keep up with credit card, medical debt, or other bills due to circumstances beyond their control. Loss of a job loss, illness, divorce, a pandemic, or other life circumstances often lead to debt that is out of control.

A lawyer experienced in filing Chapter 7 BK can help you get back control of your debt and help you achieve your financial fresh start.

CHAPTER 13 BANKRUPTCY

Our Experienced Arizona Lawyers and Arizona BK law experts will assist you with Chapter 13 BK. Schedule a FREE consultation and debt evaluation today. Our dedicated and professional attorneys can help you answer questions and give you options regarding your specific debt situation.

My Arizona Lawyers’ bankruptcy department have helped Arizona residents achieve financial freedom and get out of debt.

WAGE GARNISHMENT

One of the top reasons that Arizona residents seek bankruptcy assistance from our law firm is because their wages are being garnished. Therefore, when your debt gets out of control, you may receive a legal document known as a summons. Contact us for a free debt evaluation and a consultation to get answers regarding a wage garnishment.

If you are filing bankruptcy to stop a wage garnishment, it is crucial that your case is filed correctly and accurately by a professional attorney.

STOP A REPOSSESSION

Filing a BK petition in Arizona can stop a repossession. The Automatic Stay is put into effect as soon as the petition is filed. Therefore, consult one of our experienced attorneys if you are facing a repossession. Evaluating your debt may reveal that your financial future could be improved by eliminating debt that a bankruptcy could provide.

My Arizona Lawyers’ debt relief department has helped Arizona residents achieve financial freedom and get out of debt.

ARIZONA FORECLOSURE ATTORNEY

Our Arizona clients contact our foreclosure attorneys when faced with a home foreclosure. Thus, the assistance that an experienced foreclosure lawyer can provide is crucial when it comes to saving your home. Debt tends to rage out of control — when monthly payments cannot be made, such as the mortgage, seek the advice and assistance of an attorney. A foreclosure may be one of the effects caused by crushing debt.

If you are filing BK to stop a home foreclosure, ensure that your case is filed correctly and accurately by a professional attorney at My Arizona Lawyers.

MEDICAL DEBT

An Arizona bankruptcy may wipe out medical debt. Many of our clients with crushing and overwhelming debt due to medical bills, illness, surgery, or any medical related issues struggle to make ends meet. Despite best efforts to manage monthly household payments and pay off medical bills, an extreme debt amount or missed payments force one to look for options. Bankruptcy is a viable option to eliminate medical debt and focus on a fresh financial start.

My Arizona Lawyers’ bankruptcy experts will help you to achieve financial freedom and get out of medical debt.

Bankruptcy

Affordable BANKRUPTCY Lawyer Services in ARIZONA

ARIZONA Chapter 7 Bankruptcy ATTORNEYS

Filing an Arizona Chapter 7 bankruptcy provides debt relief for honest people in Arizona who are in over their heads with debt. Chapter 7 bankruptcy is also referred to as a “Fresh Start” bankruptcy as it provides people, both white collar and blue collar, with a new, debt free start. Many people find it difficult to keep up with credit card, medical debt, or other bills due to circumstances beyond their control; such as: job loss, illness, divorce, or other circumstances beyond their control.

ARIZONA Chapter 13 Bankruptcy ATTORNEYS

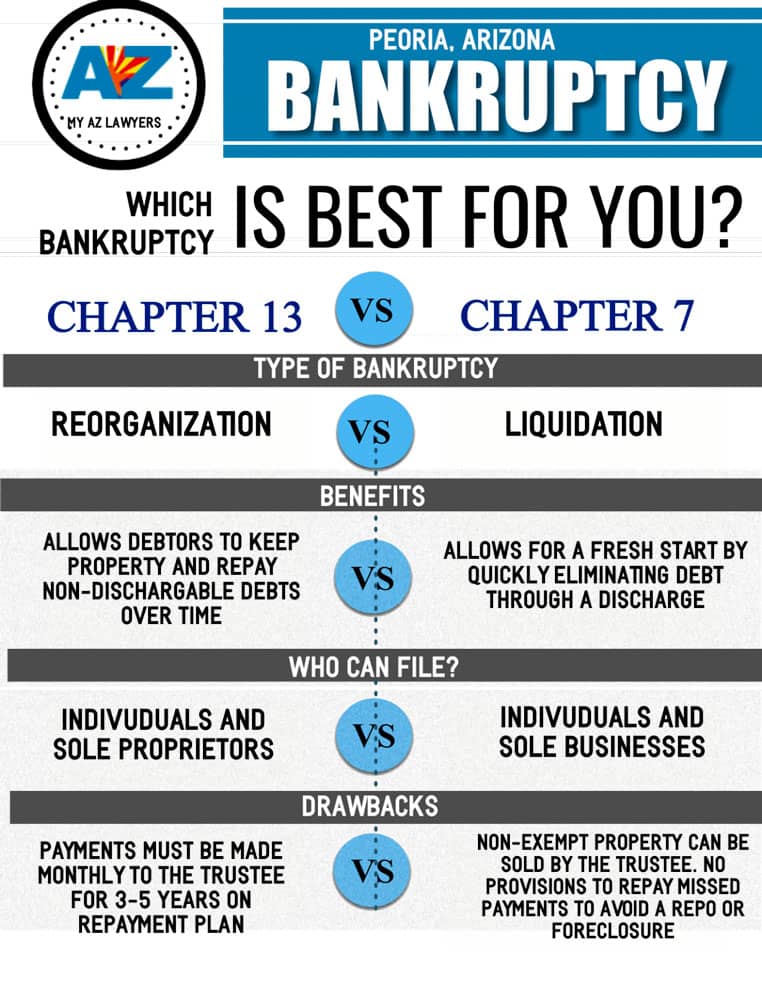

Many people in Arizona do not qualify or have debt relief needs that aren’t able to be addressed by Chapter 7 bankruptcy. Therefore, filing an Arizona Chapter 13 bankruptcy (Also called a Wage Earner’s bankruptcy) is an effective debt relief route. A Chapter 13 bankruptcy in AZ provides debtors the breathing room they need to pay back a portion of their debts over a 3-5 year period. The Chapter 13 repayment plan is tied to what you can afford.

ARIZONA ZERO ($0) DOWN Bankruptcy ATTORNEYS

Our Arizona Zero Down Bankruptcy Attorneys are now able to offer individuals, couples, and families throughout Arizona immediate debt relief by filing an Arizona Chapter 7 Bankruptcy or Arizona Chapter 13 Bankruptcy for little or $0 money down. After Filing bankruptcy, you make small monthly payments (that you can afford) to pay the rest of the bankruptcy. It’s easy to immediately stop creditors harassment with $0 Down bankruptcy in AZ.

ARIZONA DEBT RELIEF

TAKE CONTROL OF YOUR FINANCIAL FUTURE

Many people think of bankruptcy as a bad word, but in truth, bad things sometimes happen to good people. Even the most fiscally responsible people can find themselves in a tight spot after being laid off from their job, going through a divorce, being injured, or suffering an illness. Through no fault of your own, you can find your savings gone and yourself underwater financially. If you are thinking about declaring BK in Arizona, do not hesitate to call our experienced bankruptcy attorneys in Tempe, Mesa, Chandler, and throughout Arizona.

If you need relief from debt, declaring BK may be the answer to your problems. Whether you feel prey to a credit card with hidden fees and a high interest rate, or misfortune has taken your job, spouse, or health, you may find that the best way to get a clean slate is to file for a personal Chapter 7 or Chapter 13 bankruptcy.

You can start taking back control of your finances and rebuilding your credit score. Though you can legally file yourself, it is not recommended. Let our Arizona debt relief experts do the work for you. With convenient law office locations, we are the debt relief agents you seek.

My Arizona Bankruptcy Lawyers Can Help you with Debt Relief

A bankruptcy lawyer can guide you through the process and give you advice on how to save the assets you want and to discharge the debts you don’t in a Chapter 7 filing, or how to re-organize your debts to the most benefit in a Chapter 13 filing. The debt relief attorneys at My AZ Lawyers have the training and experience to advise you on the best course of action for your particular circumstances. Each lawyer at My AZ Lawyers has experience in helping clients get debt relief.

If you are ready to learn more about how debt relief may be able to help you get a “Fresh Start” and you live in Glendale, Phoenix, Gilbert, Chandler, Avondale, Mesa, or Tucson, My AZ Lawyers may be able to help you.

Call us or send us an e-mail to find out how an experienced debt relief lawyer may be able to help you start reclaiming control of your finances. Call now and schedule a free consultation, either in one of our local offices or via telephone.

Emergency Bankruptcy in Arizona

Same Day Bankruptcy Filings

Our Arizona bankruptcy attorneys can use Emergency Bankruptcy services to stop bank levies and liens, sales of the family home, trustee sale or foreclosure sale, wage garnishments, and other disruptive estate or financial activities by declaring bankruptcy. These emergent filings on your behalf are done with very short notice. Also, we offer these services throughout Arizona, including Maricopa, Pinal, and Pima Counties.

Our Arizona debt relief team offers same day bankruptcy filings. Therefore, Contact Us to schedule a same day filing, either in office or by phone. Plus, if you are in need of emergent legal representation, our Phoenix debt relief firm can help you by obtaining your information and do a same-day chapter 7 or chapter 13 bankruptcy filing.

Additionally, once you file for BK in Arizona, an automatic stay is put in place. An automatic stay is a very powerful bankruptcy tool. The stay prohibits a creditor from any further collection or legal action. Another benefit of same-day bankruptcy filings is that they can prevent a foreclosure. Plus, it can prevent a repossession. Also, same day filing stop a wage garnishment. Therefore, as you can read, there are a myriad of benefits to filing your bankruptcy right away. Therefore, put an end to harassing contact by creditors to collect debt, get help today.

The Basics of Bankruptcy in Arizona

The Supreme Court of the United States created federal BK laws to give a new start to those in serious financial debt. In order to provide new opportunities, the bankruptcy discharge releases debtors from liability from certain debt, and stops creditors from taking further legal action to collect that debt. Thus, there are different types of bankruptcy cases (named by chapters) provided under the Bankruptcy Code.

Title 11 of the United States Code is The Bankruptcy Code: a uniform federal law that governs BK cases. Each state in the nation has one or more judicial districts. Also, there is a bankruptcy court for each of these districts. Additionally, a bankruptcy judge is the official of the court. Any matter concerned with a federal bankruptcy case is decided by the judge.

In addition, a person filing has limited involvement with the judge. A meeting of creditors, also called a 341 meeting of creditors, is a formal hearing in which a debtor appears before the court.

Part of the bankruptcy process is administrative business which is conducted in a courthouse. Sometimes a case is overseen by a trustee.

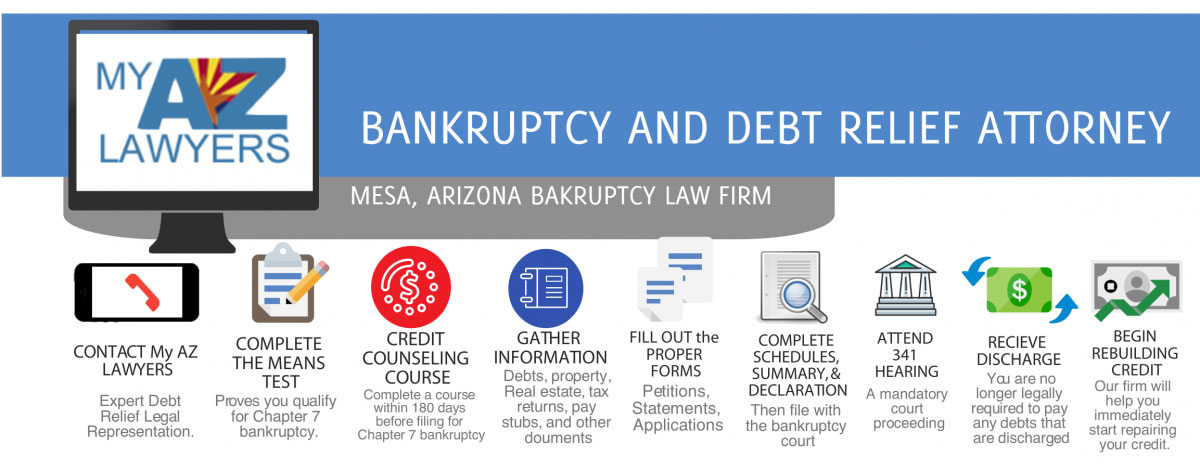

THE PROCESS OF BANKRUPTCY IN ARIZONA

Best Arizona Bankruptcy Lawyers

The bankruptcy filing process in Arizona is complex and requires knowledge of the bankruptcy law and code. Therefore, to assist you in declaring BK, it is important that you consult with an attorney who is experienced in debt relief filings in Arizona. An attorney who is truly invested in helping a client provides him/her with information. Additionally, it is also important to understand the process, legal implications, and options when making decisions that will affect your financial future.

GET THE BEST DEBT RELIEF REPRESENTATION IN ARIZONA

A great BK attorney needs to be trusted, knowledgeable of the Arizona Bankruptcy Code, and capable of providing the expert legal services to suit your needs. My Arizona Lawyers will analyze your financial situation, communicate your options, give honest advice, prepare your BK petition, review the process, attend court hearings, take any legal actions necessary to the success of your case, and follow up with you regarding your case. Additionally, our Arizona law firm even offers assistance with clients who have completed the bankruptcy process, received a discharge, and need help rebuilding credit in the post-bankruptcy stage of the process.

ESTABLISHING A CLIENT RELATIONSHIP

Therefore, when looking for an attorney, seek an attorney who is not only qualified to do the job, but one with whom you feel comfortable. My Arizona Lawyers believes in establishing a foundation of trust and professional legal service. Also, our goal is to provide affordable legal help to people in Phoenix, Tucson, Mesa, Glendale, Avondale and surrounding communities in Arizona. Besides being cost-effective, our bankruptcy law firm has experienced lawyers and staff to better serve.

Furthermore, when hiring an experienced bankruptcy lawyer, you should be able to feel free to ask questions and you should also expect to get answers that you can understand. From our Phoenix law firm you can expect information, feedback, and a staff that works with you. More than likely, the outcome of your case depends on a competent lawyer and a team on which you can depend. Call our Arizona Legal Team today.

CHOOSE THE BEST METHOD OF DEBT RELIEF FOR YOU IN ARIZONA

CHAPTER 7 VS. CHAPTER BANKRUPTCY FILING

After conferring with an attorney and assessing your debt situation, if declaring bankruptcy is the best means for your case, choose the best chapter of BK that is best for your financial goals.

With the assistance of an experienced debt relief law firm, review all your options, and begin the process toward a fresh start. Therefore, there are different reasons why clients file Chapter 7 or Chapter 13 BK.

Therefore, each chapter provides different protections and protections when eliminating debt. However, these variances within the bankruptcy chapters are best explained by knowledgeable Phoenix bankruptcy lawyers.

Contact My Arizona Lawyers to schedule a FREE DEBT EVALUATION and CONSULTATION with an attorney experienced in Chapter 7 and Chapter 13 Arizona bankruptcy law. An attorney will hep you establish which chapter filing is best for your specific debt situation.

BANKRUPTCY CREDIT COUNSELING

Any debtor filing for BK must take credit counseling. This must be done within six months before filing bankruptcy in Arizona. A financial management instructional course must be completed after filing for Chapter 7 or Chapter 13 bankruptcy. You may have questions regarding these mandatory courses. One of our Arizona bankruptcy attorneys would be glad to give you more information. Contact our AZ Debt Team today for assistance.

AUTOMATIC STAY

An automatic stay goes into effect immediately upon filing for bankruptcy with the court. Therefore, an automatic stay is a very powerful tool and beneficial to those filing. The automatic stay stops bill collectors and creditors in their tracks. Plus, the Automatic Stay is one of bankruptcy’s most powerful tools.

In Arizona, the automatic stay stops creditors from contacting or harassing you regarding your debts. It is actually illegal for them to contact you once they have been given proper notice of your filing. We can stop creditors from harassing you! Additionally, the automatic stay stops any foreclosure proceedings and any legal action against the debtor. It is also helpful in most repossession cases. There are many forms of Arizona Debt Relief the automatic stay can help.

THE BANKRUPTCY TRUSTEE

A trustee will be appointed to your case but the bankruptcy court. When you file your petition for bankruptcy, the court assumes legal control over your debts. Additionally, any property or assets not covered by Arizona exemptions is also handled by the trustee. The trustee conducts a thorough review of your paperwork. It is the job of the trustee to make sure that the assets you have and exemptions you claim are legit. This person also is responsible for paying your creditors when possible.

Our Arizona Bankruptcy Attorneys are very familiar with the bankruptcy trustees. Plus, our attorneys and staff work with the trustees daily. Please know, our experience matters when filing bankruptcy protection in AZ. Call us today. (480) 833-8000.

BANKRUPTCY PREPARATION

Part of the BK Process completing forms. Specific paperwork filed with the court is required. An attorney and legal staff will assist in this matter. You must provide information pertinent to the bankruptcy including expenses, income, assets, and debts. Next, the attorney will prepare forms needed by the court based on the accurate information you provide. Because all required documents need a timely filing, it is so important that you enlist the help of an expert in Arizona BK Law.

FILING THE BANKRUPTCY PETITION

An initial bankruptcy petition is filed. There may be additional forms needed by the court or trustee. Meeting the deadlines for submission of these forms is important so that there are no delays in the process, consequences, or case dismissal. My AZ Lawyers know the procedures, the necessary paperwork, rules, and timelines.

BANKRUPTCY HEARING (341 MEETING OF CREDITORS)

The meeting of creditors, also called a 341 hearing, is a mandatory court appearance. After filing the BK petition, the debtor is required to be at this court hearing. Your Arizona Chapter 7 attorney may need to attend additional hearings on your behalf, depending on the specifics of your case. My AZ Lawyers will let you know all about what to expect at this meeting of creditors, and prepare you fully for your appearance in court. Our attorneys will provide you with the proper legal representation at this hearing. Basically, it is a time in court for any motions or objections filed by a creditor, the trustee, or the debtor.

COMMON FALLACIES ABOUT FILING FOR BANKRUPTCY

Myths and Truths Regarding Bankruptcy in Arizona

Here are a few of the most popular Myths and Fallacies regarding Bankruptcy.

The Arizona Bankruptcy Attorneys at My Arizona Lawyers realize that there are a myriad of reasons that people have to file for BK protection. The process of filing for bankruptcy in Arizona is complex. Our Attorneys know the Arizona BK process. This is made even more difficult with the many myths and fallacies out there. In the following, our knowledgeable Maricopa County Bankruptcy Attorneys dispel common bankruptcy myths.

After Filing Bankruptcy, you will never be able to get a credit card.

Everyone will know if you declare BK.

You will be fired from your job for declaring BK in AZ.

You can file BK as many times as you want.

There is a minimum amount of debt that you need to have to be eligible for filing BK.

If you’re married, both spouses must file bankruptcy.

Filing Bankruptcy will wipe out ALL of your debts.

You will lose your home and all of your possessions if you declare bankruptcy.

If you work, you can’t file bankruptcy.

If the debtor doesn’t qualify through either method for Chapter 7, they usually qualify for Chapter 13. In Chapter 13, the debtor’s disposable monthly income will be used to calculate a payment plan that will last 3-5 years. If the debtor can pay off all mandatory categories of debts in the payment plan, and doesn’t have more than $419,275 in unsecured debts and $1,257,850 in secured debts, they will qualify for Chapter 13.

If you are going to file bankruptcy, you might as well max out those credit cards.

Understanding Bankruptcy Filing with a Phoenix Bankruptcy Lawyer

Filing for bankruptcy in Phoenix can provide relief for those struggling with overwhelming debt. It’s a federal legal process that allows debtors to either eliminate (“discharge”) their personal liability or reorganize their debts. While not all debts are dischargeable, many can be, providing a fresh start for those in need.

Balancing Interests Between Debtors and Creditors

Bankruptcy laws in Phoenix, as in the rest of Arizona, aim to balance the interests of debtors seeking relief and creditors seeking payment. For those unable to pay, bankruptcy can excuse the debt entirely. For others who have some means, it can allow for a structured repayment plan to pay back a portion of what is owed.

Immediate Relief from Collection Actions When Declaring Bankruptcy in Phoenix

One of the most significant benefits of filing for bankruptcy is the automatic stay, which immediately halts collection actions. This federal injunction prevents creditors from taking actions like foreclosure, wage garnishment, bank account seizures, and harassing phone calls. The stay remains active throughout the bankruptcy case and can become permanent once a discharge is granted.

Protecting Your Property with Exemptions

Exemptions play a crucial role in determining the assets you can keep when filing for bankruptcy. In Chapter 13 cases, you can retain all your property, though exemptions may influence the repayment amount. In Phoenix Chapter 7 bankruptcy cases, exemptions determine which assets remain protected. Most Chapter 7 cases are considered “no-asset” cases, meaning that all the debtor’s property is exempt, and surrendering property is often unnecessary. A skilled bankruptcy lawyer can help maximize your exemptions to protect your assets.

Removing Liens in a Bankruptcy Filing

Liens give creditors rights to specific property. They may be voluntary (like a mortgage) or involuntary (such as those resulting from a lawsuit judgment). Involuntary liens can often be removed if the property’s value, existing liens, and exemptions meet certain criteria. While voluntary liens are typically harder to remove, in Chapter 11 or 13 cases, liens that are wholly unsecured (where property value is less than the owed amount) may be eliminated if additional requirements are met.

For more information on how bankruptcy exemptions can protect your assets, consult with a Phoenix bankruptcy lawyer to explore your options in declaring bankruptcy in Maricopa County.

THE BK DISCHARGE

After fulfilling all requirements of a bankruptcy and completing the process, a discharge is granted by the court. The debtor is not required by law to repay any debts owed that have been discharged through filing BK. Also, a creditor may not take any further legal action against, nor make any attempt at contacting, the debtor. A discharge is the permanent order preventing creditors from taking any actions to collect a discharged debt. Once a BK is discharged, the debtor is released from any personal liability for certain debt.

A bankruptcy discharge will be granted typically if there is no objections or litigation involving the discharge. The attorney as well as the debtor will receive copies of the order of discharge. The debts that are discharged vary under each chapter of the bankruptcy code. Consult with your Arizona Chapter BK attorney as to what the Arizona BK exemptions are and which kinds of debt can be erased.

HOW TO FIND THE BEST ATTORNEY TO ASSIST YOU IN THE BANKRUPTCY FILING PROCESS

Before Arizona residents seek out assistance for a BK, they often go in search of the best debt relief lawyers in their area. Of course, it is imperative to have the right attorney to represent you in your quest for a fresh financial start.

First, take advantage of the free consultation and debt evaluation offered by My Arizona Lawyers Law Firm. In office or by phone, you will be able to meet with a Phoenix Bankruptcy attorney. In this initial consult, you will be able to find out more about the firm, the cost of filing, and the Arizona Debt Relief team. You will be able to ask questions about the specifics of your case and seek some advice from an experienced, trusted professional.

REASONABLE FEES AND COMPETENT ATTORNEYS

My AZ Lawyers has competent attorneys. Driven by their expertise in Arizona Law and confidence in the debt relief process, My Arizona Lawyers can deliver on expert bankruptcies and debt relief legal services in Maricopa, Pima, and Pinal Counties. Therefore, when you call to make an appointment for a free debt evaluation, find out what a typical fee is going to be for a Chapter 7 or Chapter 13 case. Also, our law firm provides affordable legal service for Arizona.

Choose a lawyer who will communicate effectively and give you an idea of his/her availability. Our attorneys and debt relief staff will handle the routine aspects of the process, and make sure that someone is accessible. It is also important to our clients to be able to easily schedule appointments and get phone calls returned.

Choose A Phoenix, Arizona Bankruptcy Attorney You Can Trust

EFFECTIVE ATTORNEY-CLIENT COMMUNICATION

You need clear, honest, accurate answers when trying to achieve financial freedom. Clients rely on the legal staff to take charge of a case and provide desired results. It is also in your best interest to participate fully in your case and to feel comfortable with the attorney who represents you. After retaining an experienced $0 Down bankruptcy attorney, you should feel confident that your attorney can offer answers to you at anytime you have questions regarding your case.

SOUND LEGAL ADVICE

Your attorney should hear your goals for your particular debt issue and make judgement and recommendations for your specific needs. My AZ Lawyers can outline the exact services provided by our Arizona Legal Team. At our law firm, you can expect legal advice that is in the best interests of your case. Our experienced Arizona attorneys will provide information about what you can expect from the entire bankruptcy process, and how to use BK protection to achieve your financial goals. Additionally, what type or chapter of BK is also an important decision when managing debt.

You should be cautioned by a lawyer if there may be any risks or difficulties that you may encounter through the course of your case. Setting clear expectations and giving solid information about the process is part of what makes our law firm successful in representing clients in Arizona.

ARIZONA BANKRUPTCY EXEMPTIONS

Arizona’s law details the property that you can protect, or exempt, from creditors when you file. There is a listing of exemption categories, and dollar amounts. Thus, certain debts may not be wiped out in a Chapter 7 or Chapter 13 filing. Exempted property, however, you may be able to deep after you file bankruptcy. Some debts that cannot be erased in a bankruptcy include alimony obligations or debts due to family support or back child support. Also, debts caused by driving while under the influence that involve death or personal injury can not be eliminated. Nor can student loans, tax law fines or penalties, income tax debts, or debts you do not list in your bankruptcy paperwork.

The experienced Arizona attorneys at My Arizona Lawyers are experienced in Arizona BK law. They know the exemptions and can help with exactly which debts can be discharged and which assets and properties can be exempted. There are some specifics to the exemption laws like exemption limits, properties secured by loans, and valued assets. Some federal exemptions may also apply. Trust My AZ Lawyers to completely cover the Arizona exemptions covered under the law. Additionally, our law firm will work to seek out the best resolution and benefits for your case. What about non-exempt property? To keep these, generally what happens is the debtor pays the trustee the value of this property.

Phoenix Bankruptcy Lawyer FAQs

MARICOPA COUNTY BANKRUPTCY ATTORNEY FAQ’s With My AZ Lawyers

THE DIFFERENT CHAPTERS OF ARIZONA BANKRUPTCY PROTECTION

CHAPTER 7 BK

Chapter 7 is also known as a liquidation bankruptcy. Basically, a trustee analyzes the assets of the debtor, liquidates them, then distributes money owed to creditors. There are nonexempt properties in Arizona Chapter 7 cases, so in some cases, there may be no liquidation of the assets. An individual who receives a discharge in Chapter 7 is released from all personal liability for certain debts.

THE BANKRUPTCY MEANS TEST IN ARIZONA

An applicant for BK in Arizona must first complete a means test. This is a part of the process to determine if you are even are eligible for filing Chapter 7 or Chapter 13. An attorney can help you with this test that will determine whether you qualify for relief under Arizona Chapter 7 bankruptcy protection. Basically, the test shows if the debtor’s income exceeds a predetermined threshold.

ARIZONA CHAPTER 9 BANKRUPTCY.

Chapter 9 bankruptcy is for: cites, towns, counties, school districts, villages, or municipal utilities. Also, Chapter 9 BK is basically a reorganization of debt.

CHAPTER 11 BANKRUPTCY IN PHOENIX.

Usually, a debtor in a Chapter 11 is a commercial enterprise. Filing Chapter 11 is also referred to as reorganizing debt. Thus, when the debtor wishes to continue operating a business, reorganizing debt allows them to repay creditors through an approved plan. After providing a disclosure statement, a plan of reorganization is created, and if approved by the creditors, is used to repay of portion of debts. The repayment plan can also include other operations including asset recovery, or termination of contract. A Chapter 11 process includes debt reorganizing and debt consolidation.

CHAPTER 12 ARIZONA BAKRUPTCY.

The Chapter 12 bankruptcy process provides debt relief and protection to fishermen and family farmers with stable income. A plan is proposed by the debtor to repay debts over a period of time. Typically, the repayment is under three years. A trustee is involved in a Chapter 12 BK. Plus, the trustee distributes payments to creditors per an agreed plan. Additionally, a farmer or fisherman can keep operating a business while executing the Chapter 12 payment plan schedule.

CHAPTER 13 BANKRUPTCY ATTORNEY IN PHOENIX.

Chapter 13 is an option for BK designed to permit a debtor to keep assets of value. It allows for a plan to repay creditors over a period of time. If a debtor does not meet the requirements to file Chapter 7, then Chapter 13 filing is an option. Once the payment plan is approved, a trustee is used to oversee the plan and make payments to creditors. During the course of the payment plan, the debtor is protected from garnishments, creditor lawsuits or other actions.

CHAPTER 15.

The goal of a Chapter 15 is to provide a uniform cooperation between the United States court system and authorities and the courts of foreign countries. This filing promotes the protection and administration of cross-border insolvency cases. It serves to protect the interests of creditors and debtors involving another nation.

A LAW FIRM ABLE TO HANDLE YOUR DEBT RELIEF NEEDS

My AZ Lawyers has a reputation for successfully representing Arizona clients through the bankruptcy process. This is so because the attorneys are familiar and experienced in the Arizona and federal BK laws. Plus, My AZ Lawyers know the Arizona courts, judges, trustees, and procedures. Our good reputation precedes us. We will be able to assist you with your BK filing.

Commonly, the difficult decisions are made depending on if you file for Chapter 7 or Chapter 13 BK. Therefore, our AZ Debt Relief Firm has the skills needed to handle your case. Our seasoned BK staff updates you on your case if necessary. Additionally, our experienced BK attorneys provide updates and current information with developing changes.

Experienced Arizona Bankruptcy Attorneys

Contact our Arizona Debt Relief Team for a free consultation and evaluation of your debts. Both the consultation and the advice are FREE. Plus, the consults are 100% confidential.

WHAT TO DO WHEN FACED WITH BANKRUPTCY IN ARIZONA

Our Phoenix Bankruptcy Lawyer takes a look at how to approach a bankruptcy filing in AZ. The first step to declaring BK in Arizona is becoming familiar with the process of filing bankruptcy. Though there is a lot of information readily available on-line, the best choice that you can make is seeking out an experienced bankruptcy attorney that can be by your side every step of the way. Our Phoenix BK attorneys work with individuals, families, and businesses seeking debt relief and bankruptcy protection. Our experienced BK lawyers have successfully filed over 5000 cases for Phoenix area residents seeking assistance with bankruptcy and debt relief matters in Maricopa County, Arizona.

DISCHARGE MEDICAL BILLS

Discharge Your Medical Bills in Phoenix Through Declaring Bankruptcy

Phoenix Medical Debt Attorney

Our Arizona Bankruptcy Office Locations

My Arizona Lawyers has locations throughout Arizona including BK law offices in: Phoenix, Tucson, Mesa, Glendale, and Avondale. Plus, our experienced and skilled attorneys analyze your finances and conduct a debt evaluation of your circumstances while determining what debt relief option is best for you. Call (480) 833-8000 for a free confidential appointment to begin your “Fresh Start”.

Eliminate Medical Debts in Arizona and Get a Fresh Start to Financial Freedom

Carrying large amounts of medical debt will severely limit your ability to improve your credit. Thus, even if you do enter into a monthly re-payment plan for your medical debts, the high balances of the medical debt will limit how much you may be able to increase your credit score. Keep in mind, credit ratings and credit scores do not improve over time if you owe large debts related to unpaid medical bills. Sometimes discharging medical debt is the best solution.

Hospital bills and expenses incurred when dealing with medical issues are both debts you can discharge in a chapter 7 or chapter 13 bankruptcy. Therefore, filing for bankruptcy protection in Phoenix or Tucson, Arizona is a possible way out of your financial troubles, allowing you to concentrate on getting your body healthy again.

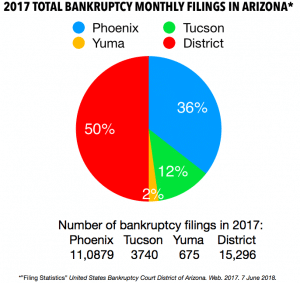

ARIZONA BANKRUPTCY FILINGS

“Can Helping out my Family or Parents Impact my Arizona Bankruptcy Filing?”

Assisting family members or parents financially before filing for bankruptcy in Arizona can indeed have implications on your bankruptcy case. It primarily revolves around what’s termed as “preferential payments.”

Preferential payments refer to transactions where a debtor pays off certain creditors, typically family members or close associates, before filing for bankruptcy. These payments might seem innocent or well-intentioned, but they can lead to complications during bankruptcy proceedings.

In Arizona, as in most states, preferential payments made to family members within a certain timeframe before filing for bankruptcy can be scrutinized. If a bankruptcy trustee determines that these payments were made to “insiders” (family members or close associates) within the 12 months preceding the bankruptcy filing, they might be deemed preferential.

The rationale behind this scrutiny is to ensure that all creditors are treated fairly in the bankruptcy process. By repaying family members or close associates before filing for bankruptcy, you might be seen as unfairly favoring them over other creditors.

Penalties for preferential payments can include:

Clawback: The bankruptcy trustee can demand that the family member or associate return the payment made to them within a specified period. This amount would then be included in the bankruptcy estate and distributed among all creditors.

Denial of Discharge of your Arizona Bankruptcy Filing: If the bankruptcy court finds that you made preferential payments with the intent to defraud creditors, your bankruptcy discharge could be denied by your bankruptcy trustee. This means that you would remain liable for the debts even after completing bankruptcy proceedings.

Potential Legal Action: In extreme cases, the bankruptcy trustee or creditors could take legal action against the family member or associate who received the preferential payment to recover the funds.

Given these potential repercussions, it’s essential to exercise caution when providing financial assistance to family members or parents before filing for bankruptcy. Consulting with a qualified bankruptcy attorney can help you understand the implications of such payments and navigate the bankruptcy process effectively. Seek the assistance of our Phoenix Bankruptcy Lawyers when needing help with preferential payments in a Chapter 7 or Chapter 13 filing in Maricopa, Pima, and Pinal Counties and throughout Arizona.

FILING FOR BANKRUPTCY IN AZ

“Can I pay back my sister money that I borrowed from her prior to filing for BK in AZ?”

Similar to the scenario mentioned above, repaying money borrowed from a sister or any other family member before filing for bankruptcy in Arizona can raise concerns about preferential payments with an Arizona Bankruptcy Trustee.

If you repay a loan to your sister within the 12-month period preceding your bankruptcy filing, it could be considered a preferential payment. The AZ bankruptcy trustee might scrutinize such transactions to ensure they don’t unfairly benefit your sister over other creditors.

However, there are some nuances to consider when paying or repaying money prior to a chapter 7 or chapter 13 bankruptcy filing in Phoenix, Tucson, Mesa, or Chandler, Arizona.

Ordinary Course of Business: If repaying the loan to your sister is part of your regular financial transactions and not done with the intent to defraud creditors, it may not be deemed preferential.

Arm’s Length Transaction: If the loan repayment to your sister is at market rates and made under normal commercial terms, it’s less likely to be considered preferential.

Consult with a Bankruptcy Attorney: To ensure compliance with bankruptcy laws and avoid potential complications, it’s advisable to consult with a bankruptcy attorney before making any payments to family members or other creditors before filing for bankruptcy.

In conclusion, while repaying debts to family members or others before filing for bankruptcy may seem like the right thing to do, it’s crucial to understand the potential implications. Consulting with a knowledgeable bankruptcy attorney can help you navigate these complexities and make informed decisions regarding your financial obligations before and during bankruptcy proceedings.

Get In Touch with Our Debt Relief Team