Peoria, Arizona Bankruptcy Lawyers

Chapter 7 Bankruptcy ATTORNEYS IN PEORIA, ARIZONA

Our Peoria Chapter 7 bankruptcy attorneys can give you the financial freedom you want without the headache. Thus, when you’re at the end of your rope, you might wonder if Chapter 7 bankruptcy the life line you need. Filing Chapter 7 bankruptcy is a way to wipe out your unsecured debts and begin with a “Fresh Start”.

PEORIA Chapter 13 Bankruptcy ATTORNEYS

Our Peoria Chapter 13 bankruptcy attorneys know that good people like you need financial help from time to time. However, what you might not know is that, even when you’re down on your luck, you have options. Let our Arizona bankruptcy lawyers help you understand how exactly Chapter 13 bankruptcy works.

PEORIA ZERO DOWN ($0) TO FILE Bankruptcy

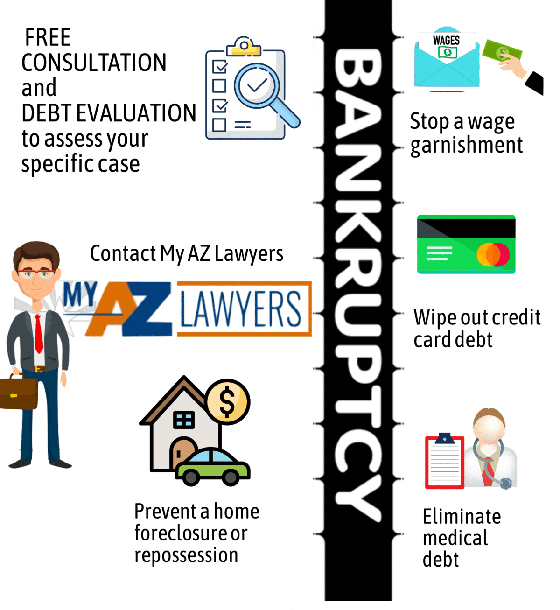

With our $0 down bankruptcy program, filing bankruptcy becomes a possibility for Peoria and North Phoenix residents who cannot fund the legal fees up front. Therefore, you can file bankruptcy with our Peoria Bankruptcy Attorneys with no money down. We also offer free consultations (Either in our Peoria Office or by phone).

CONTACT OUR PEORIA BANKRUPTCY LAWYERS FOR A “FRESH START“

How Can Bankruptcy Help Me?

Top employers in Peoria include the public schools, government, and low-paying retail companies. Thus, Peoria’s economy continues to limp along, budget cuts continue to be made. Many Peoria, AZ residents are struggling to make ends meet. Plus, some are looking for debt relief to climb their way out. Filing Chapter 7 or Chapter 13 Bankruptcy can be the solution that many need.

Additionally, we realize many people have a negative view of bankruptcy seeing it as failure. In reality, declaring bankruptcy is designed to give people a chance to start over. Also, bankruptcy is protection afforded under the law. Therefore, sometimes filing for bankruptcy in Peoria, AZ through experienced Peoria bankruptcy services like My AZ Lawyers is the best way to overcome your debt.

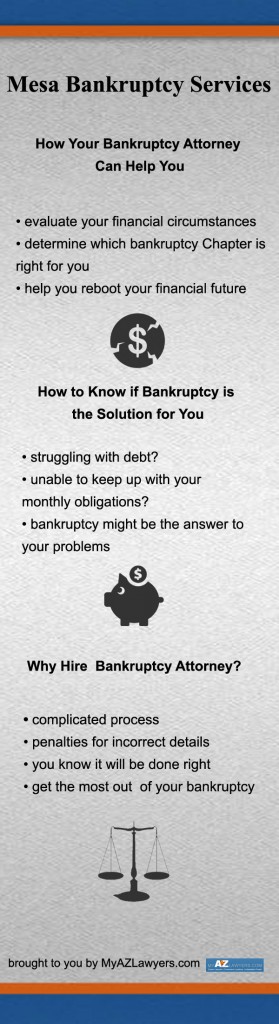

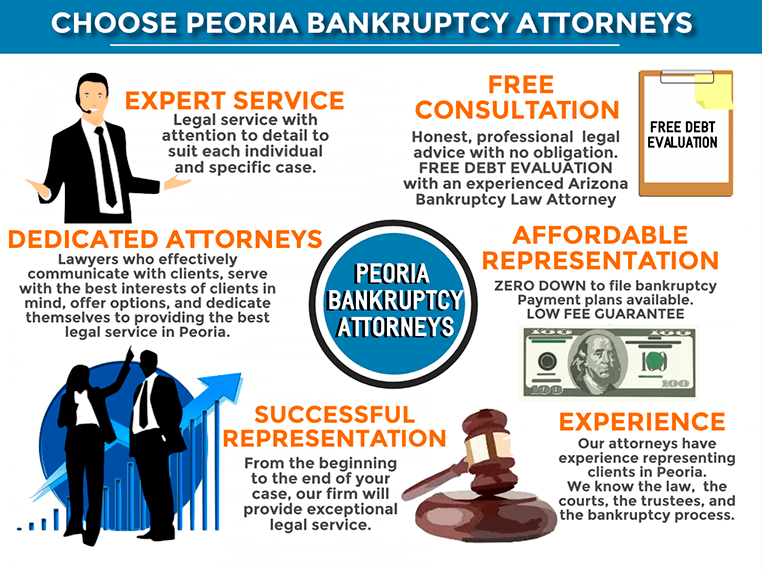

Peoria Bankruptcy Attorneys at My AZ Lawyers Can Help

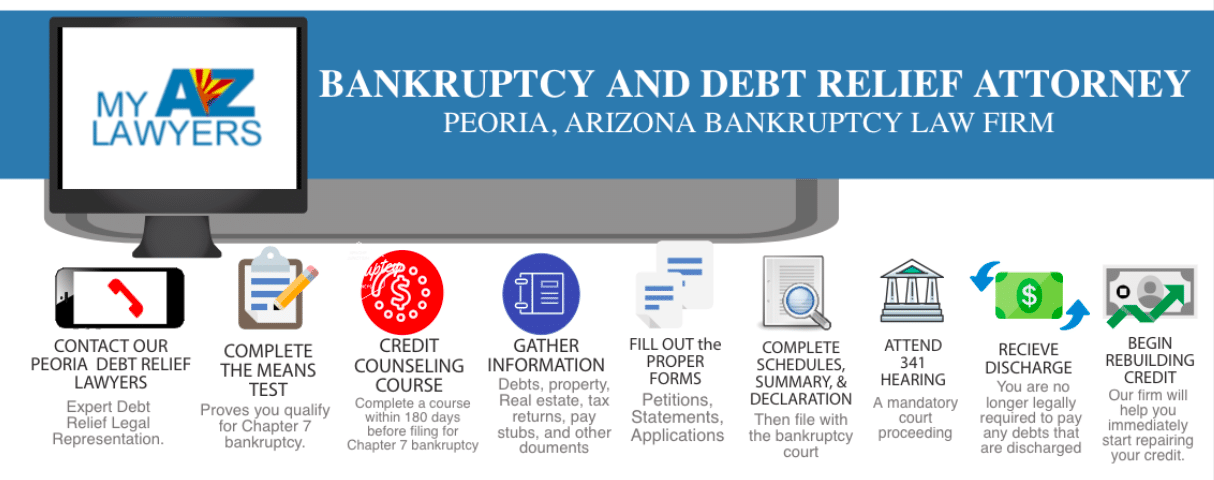

If you are struggling with seemingly insurmountable debts, a Peoria bankruptcy lawyer may be able to help you get the debt relief that you need. Plus, the Peoria bankruptcy attorneys at My AZ Lawyers can evaluate your circumstances and let you know how bankruptcy may be able to help you. Additionally, the experienced lawyers at My AZ Lawyers can recommend what chapter of bankruptcy might be best for you and can help guide you through the process. Also, the Peoria bankruptcy services are provided with a low fee guarantee. Start now with a free consultation.

Though you technically can file for bankruptcy yourself, it is not recommended. Filing for bankruptcy can actually be a complicated process, and failing to get all the details just right can result in severe penalties. By working with a bankruptcy lawyer, you can ensure that all the paperwork is filed appropriately, and that you are taking advantage of all the opportunities that bankruptcy affords you, such as the possibility of keeping certain assets.

Our Peoria Bankruptcy Team

Our Peoria bankruptcy lawyers make sure that every document in your bankruptcy is filed completely and correctly. Thus, by hiring a competent and experienced Peoria bankruptcy attorney, you can be sure that nothing goes overlooked. Plus, bankruptcy is stressful and intimidating. However, having appropriate legal counsel relaxes your stress. Plus, the road to a brighter financial future is certain. Therefore, our Peoria debt lawyers understand the emotional toll debt and bankruptcy has on our clients. We we work swiftly and efficiently so that you can get a good night’s sleep sooner and a “Fresh Start”.

Peoria, Arizona Chapter 7 Bankruptcy Attorney

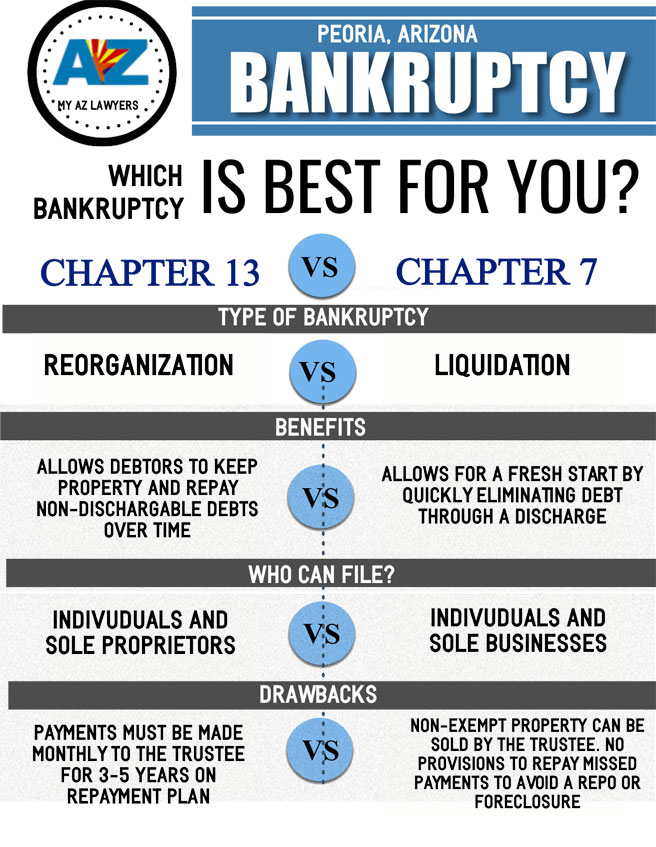

Peoria Chapter 7 bankruptcy is also known as liquidation bankruptcy, because assets can and may be used to pay off your creditors. Plus, if Chapter 7 is the right fit for you will be determined with the means test and during a consultation with our chapter 7 lawyers in Peoria, Arizona. Additionally, the moment we file for Chapter 7 bankruptcy an automatic stay will prevent all collection attempts from creditors. Also, the length of this automatic stay can vary. Therefore, you should consult with our Peoria bankruptcy attorney about the terms of a Chapter 7 bankruptcy and its implications in your personal financial situation.

Peoria Chapter 13 Bankruptcy Attorneys

A Peoria Chapter 13 bankruptcy is also known as a reorganization bankruptcy, because your debts are reorganized by a payment plan that allows you to pay off your creditors over the course of three to five years with your monthly income. Unlike in a Chapter 7 bankruptcy, you will probably be able to keep most if not all of your assets as they are not used to satisfy the claims of your creditors. Chapter 13 is a consumer bankruptcy that is designed to alleviate the financial burden that our clients carry with them while trying to keep up with their bills.

Forget what you think you know about bankruptcy and contact our Peoria bankruptcy team today. Whereas, we help you find peace of mind and assist you in taking charge of your financial future. Therefore, put an end to sleepless nights and days of endless worry and meet with a bankruptcy attorney today. Also, Arizona Bankruptcy laws are in place to give people struggling with debts a helping hand. Additionally, bankruptcy lawyers take away the shadow of debt that is hovering over people in debt. Thus, you should take the first step today. Get your Fresh Start!

Find out how to get debt relief in Peoria, Arizona. Plus, take back the control of your finances. Call My AZ Lawyers today. Additionally, a Peoria bankruptcy lawyer gets you the clean slate that you need. Also, our Peoria bankruptcy law office offers FREE evening and weekend consultations by appointment. Therefore, call and schedule a consult with our Peoria bankruptcy services today.

Loved The Communication!!

Pam T. – Mesa

“Definitely impressed by the communication factor they displayed.”

Give Them A Call!

Troy L. – Scottsdale

“I have already recommended them to three of my friends!”

WHICH CHAPTER BANKRUPTCY IS BEST FOR YOU?

CONTACT OUR PEORIA, AZ BANKRUPTCY ATTORNEYS

(480) 448-9800

Chapter 7 Bankruptcy vs. Chapter 13 BK.

Both Chapter 7 and Chapter 13 bankruptcy each provide different types of debt relief. Thus, our Peoria bankruptcy attorney is best suited to advise as to which bankruptcy solution benefits you. Whereas, filing Chapter 7 bankruptcy or Chapter 13 bankruptcy in Peoria, Arizona depends upon a number of factors. Therefore, contacting our Peoria debt relief team to explain the differences in the bankruptcy chapters is a wise choice.

What is Chapter 7?

Chapter 7 bankruptcy is generally a fast bankruptcy; the cases usually last about three to four months, and you can discharge credit card debt, medical bills, personal loans, utilities and some income tax debts without having to repay them. Plus, you can keep your house and your car in Chapter 7 if you can afford the payments and if you are current on your payments, but you must repay these loans if you want to keep the property. Therefore, if you have debt that is nondischargeable, such as child support, alimony and most student loans and some taxes, you will still be responsible for them after a Chapter 7. Contact our Peoria Chapter 7 bankruptcy lawyers for a free consultation today.

What is a Peoria Chapter 13 Bankruptcy?

A Chapter 13 bankruptcy is a chapter of bankruptcy with a repayment arrangement. Whereas, you propose to repay your creditors over the next three to five years in a Chapter 13 repayment plan. Also know, some creditors will receive more than others. Thus, you can use a Chapter 13 to catch up on your house payments, pay off your car, pay back the IRS debt, and even repay back child support. Additionally, at the end of the case, you receive a bankruptcy discharge that wipes out any remaining debt that you would have discharged in a Chapter 7. Therefore, if you are looking for a fresh start in Peoria, Arizona; contact our Peoria Chapter 13 bankruptcy attorneys today and get the process started.

Who Should File Chapter 7 Bankruptcy?

Chapter 7 is for those who:

- Have a lot of unsecured debt, like credit card debt and medical bills.

- Are current on their house and car payments or are interested in walking away from the house and the car because they are too costly.

- Cannot afford to repay their debts after paying for their reasonable, necessary expenses required to support themselves and their families.

Who Should File Chapter 13 Bankruptcy?

Chapter 13 bankruptcy can help people who:

- Need debt relief but have sufficient regular income to enter a repayment plan.

- Want to save a home from foreclosure, sheriff sale or tax forfeiture.

- Need to save a car from repossession.

- Want to stop IRS penalties and interest and repay nondischargeable income taxes.

My AZ Lawyers

Mesa, AZ 85202