Mesa Bankruptcy SERVICES

Debt Relief – Bankruptcy Attorneys in Mesa

The need for Mesa Bankruptcy services can come from anyone in Mesa, Arizona. Some of the top employers in Mesa include the public schools, government and low-paying companies like retail establishments. As the economy continues to limp along in these sectors and budget cuts continue to be made, many residents are struggling to make ends meet. Some may find themselves in over their heads and looking for debt relief to climb their way out. Bankruptcy can be the solution that many people need.

Many people in Mesa have a negative view of bankruptcy, seeing it as a kind of failure. In reality, bankruptcy was designed to give people struggling with debts a chance to start over. Therefore, it is protection afforded under the law to avoid financial ruin. Sometimes filing for bankruptcy in Mesa, AZ through experienced Mesa bankruptcy services like the bankruptcy attorneys at My AZ Lawyers is the only way to overcome your debt and get a fresh start.

Mesa Bankruptcy Attorneys at My AZ Lawyers Can Recommend What Chapter Of Bankruptcy Is Best

If you are struggling with seemingly insurmountable debts, a bankruptcy lawyer may be able to help you get the debt relief that you need. The Mesa bankruptcy attorneys at My AZ Lawyers can evaluate your circumstances and let you know how bankruptcy may be able to help you. The experienced lawyers at My AZ Lawyers can recommend what chapter of bankruptcy might be best for you and can help guide you through the process. The Mesa bankruptcy services from our Mesa debt relief firm are provided with a low fee guarantee and start with a free consultation.

In Arizona, though you technically can file for bankruptcy yourself, it is not recommended. Filing for bankruptcy can actually be a complicated process, and failing to get all the details just right can result in severe penalties. By working with a bankruptcy lawyer, you can ensure that all the paperwork is filed appropriately. Additionally, you are taking advantage of all the opportunities that bankruptcy affords you, such as the possibility of keeping certain assets.

Our Mesa Bankruptcy Team

Mesa Chapter 7 Bankruptcy Attorney

Mesa Chapter 13 Bankruptcy

CHAPTER 7 BANKRUPTCY FREQUENTLY ASKED QUESTIONS

Bankruptcy Attorneys in Mesa, AZ FAQS

CALL OUR MESA BANKRUPTCY TEAM TODAY AT (480) 833-8000

Forget what you think you know about bankruptcy and contact our Mesa bankruptcy services today. We can help you to find peace of mind and assist you in taking charge of your financial future. Plus, our Mesa bankruptcy team put an end to sleepless nights and days of endless worry. Additionally, Arizona bankruptcy laws are put in place to give people struggling with debts a helping hand. Whereas, Mesa bankruptcy is designed to take away the shadow of debt that is hovering over people. Therefore, you should take the first step today, you will be glad you did.

Find out how you might be able to get debt relief and start taking back control of your finances by calling My AZ Lawyers today. A Mesa bankruptcy lawyer may be able to work with you to get you the clean slate that you need. Also, our Mesa bankruptcy services office offers FREE evening and weekend consultations by appointment. Call 480-833-8000 and schedule a consult with a Mesa bankruptcy attorney from our Mesa bankruptcy services today.

Mesa, Arizona Bankruptcy Overview

A Chapter 7 bankruptcy filing is an option for debt relief if you need asset protection, debt management, and to wipe out unsecured debt such as credit card debt and medical bills. Thus, depending on your specific situation, your combination of debt, property, and income, declaring bankruptcy protection is the solution to your debt relief needs.

In many cases, Arizona bankruptcy law is designed to help those who have large amounts of debt. Plus, people in Mesa impacted by economic circumstances. People facing devastating hardships such as a divorce, unexpected or uninsured medical expenses, or loss of a job. Additionally, some of the situations that lead people to filing bankruptcy include: the debt becoming unpayable, divorce, an unexpected medical procedure, or the penalties on missed payments of credit cards or other bills become impossible to catch up. In these cases, a bankruptcy helps provide assistance. Declaring bankruptcy in Mesa provides a new beginning and a clean financial slate for overwhelming debt.

Stop Creditor Harassment by Filing Bankruptcy in Mesa, Arizona

Additionally, you evade the constant phone calls from creditors. However, the penalties and interest continue to accumulate until payment is made on the debt. Filing bankruptcy in Arizona stops any attempt by a creditor to collect a debt. Thus, our Mesa bankruptcy services assist.

Therefore, contacting a Mesa bankruptcy attorney at My AZ Lawyers today. Stopping creditor calls and avoiding answering your phone. Plus, an experienced Mesa debt relief attorney helping you stop creditor harassment. Also, under the Exemption Laws of Arizona, unsecured creditors cannot take your property if it falls under these exemptions.

Keep in mind, some kinds of debt are not discharged by a bankruptcy, nor can bankruptcy protect you against collection. Child Support, Spousal Support (alimony), certain tax debt, and student loans are examples of this debt. Because every case is different, it is best to consult with a lawyer to protect your assets. Dealing with your debt in the best manner is with attorney assistance. Plus, My AZ Lawyers bankruptcy team are experienced in helping Arizona residents get out of debt. When it comes to a big decision such as filing bankruptcy, experience matters. Our Mesa bankruptcy attorneys have successfully filed thousands of Arizona bankruptcies.

Experience Counts!

Experience counts! Debt relief experience counts when addressing your financial freedom. Thus, having an experienced attorney knowledgeable about the Arizona Bankruptcy code is crucial. Plus. knowing that you have a team of debt relief experts to protect your rights lends relief. Also, our team protects your interests and financial goals. Additionally, we work with you through the entire bankruptcy process. Whereas, an attorney at My Arizona Lawyers reviews evaluations of your debt, income, and property. Thus, guaranteeing the best possible outcome for your Mesa debt relief case.

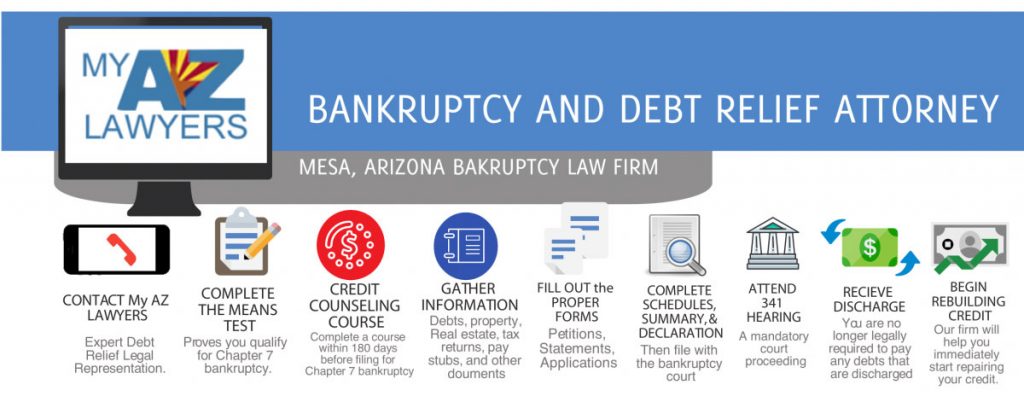

The Mesa, Arizona Bankruptcy Process

There are different types of bankruptcy. Whereas, in order to qualify for Chapter 7 bankruptcy in Arizona, you must pass a means test. This is a calculation of your average monthly income for the past six months. If the amount for the size of your household is below the state median, you meet the requirements that allow you to qualify for Chapter 7 bankruptcy. Chapter 7 is a bankruptcy which allows a debtor to wipe out most or all unsecured debts. If there is any non exempt property, a bankruptcy trustee assigned to the case will take the property in order to pay back creditors. Arizona has exemption laws which protect certain assets. Typically, most Arizona residents who file Chapter 7 have no non-exempt equity or property, whatever they do own is protected by the exemption law. A Chapter 7 process in its entirety takes several months to complete.

Chapter 13 bankruptcy includes a proposed and approved repayment plan to pay back a portion of the debt that makes it possible to catch up on payments over time. The process takes three to five years and is used by those who have secured debt or do not qualify for Chapter 7. Basically, a bankruptcy court trustee monitors the case, and makes sure the creditors are paid per the repayment plan.

CHAPTER 13 REPAYMENT TAKES 3 TO 5 YEARS

Chapter 13 takes 3 to 5 years. Instead of giving up property, you repay a portion of your debts and live within a strict budget that is monitored closely by the bankruptcy court trustee. If you can’t make the required monthly payments, your Chapter 13 bankruptcy fails and your debts will remain (unless you convert to a Chapter 7 bankruptcy).

The Arizona bankruptcy law can be complex. Do you meet the qualifications to file bankruptcy? Which bankruptcy chapter is best for your specific situation? What are the Arizona exemptions? How does the Arizona median income apply to your household, income, and debt? Forms can be long and complicated. Filings and paperwork can be overwhelming and intimidating. My AZ Lawyers know the Arizona bankruptcy process well and have helped Arizona residents successfully file bankruptcy, eliminate debt, and get their financial life back on track.

Anyone preparing to file for bankruptcy in Arizona must complete credit counseling. This certificate can be earned by completing the course online. This is an approximately 90 minute session that gives you information and helps you take a look at your financial situation.

WHEN YOU NEED BANKRUPTCY PROTECTION

Our Mesa Bankruptcy attorneys will help you determine if bankruptcy is your best option to get out of debt. In some cases, alternatives such as debt settlement or debt consolidation is the better answer. Typically, bankruptcy is an option for you if you have such overwhelming debt that it is impossible to pay it, and it is causing you to miss other monthly payments.

WHEN TO FILE BANKRUPTCY – TIMING IS IMPORTANT

Losing a job can result in a bankruptcy situation. Thus, if you lose your income, and have little or no savings, you are at the mercy of finding a new career that will pay the bills. Therefore, for some Mesa residents, this takes months to regain employment. Meanwhile, with no income for an extended period of time, bills add up. Needing to patch the situation, people turn to credit cards, loans, or payday loans. Now, on top of no paycheck, minimum monthly payments come due. It’s an unfortunate situation, but the hole keeps getting deeper and deeper. Realistically, you need to get out form under your debt. Even if you find employment, the debt situation may have gotten severe.

If you seek Chapter 7 bankruptcy to erase debt, it is important to understand that you need to take action. Additionally, the timing of a bankruptcy filing matters. First, you must see if you qualify for the discharge of debts through Chapter 7. Also, your income cannot exceed a certain amount for the size of your household. This test used to determine Chapter 7 eligibility is called the Means Test.

If you lost your job, then gain employment, that is great! But if you are in need of a bankruptcy, and your new income exceeds the Arizona median income limit, and you can’t pass the Means Test, you may not be able to discharge all of your debts.

In other words, if you have gone with out a job or income for a long period of time, and in this period of time accumulated debt, you may want to file before finding a new job. A bankruptcy will eliminate your debt and you can then start fresh with new employment and no debt.

BANKRUPTCY AND CREDIT CARD DEBT

Trying to stay one step ahead of making the minimum payments on numerous credit cards is stressful. Because credit card companies charge interest, paying off maxed out balances on several cards would take a very long time, if it is even possible. Even if you continue to make the minimum payments, with interest that is charged, it barley moves the needle to pay off the balance.

You may be caught in the cycle of credit card debt. Credit card debt is usually the kind of debt that may be eliminated through a bankruptcy. Thinking of your future, how long is it really going to take to pay your credit card debt if you only make a minimum monthly payment. Sometimes life throws a curve ball, and you might have to use the credit card payment for another emergency. Again, you go into debt a little deeper.

It’s time to schedule a free consultation and debt evaluation with an attorney at My AZ Lawyers. We will give professional advice, and honest answers as to if you are in a debt situation that would benefit from filing bankruptcy.

BANKRUPTCY AND MEDICAL DEBT

The high cost of medical care and inadequate insurance coverage may result in an extreme amount of medical debt. Medical bills may be discharged in bankruptcy in Mesa. Not only is it important to evaluate the medical debt you have already owe, but also to look at any future medical services you may need. In order to maximize the benefit of a bankruptcy and medical bills, timing is crucial.

BANKRUPTCY PLANNING

To help you achieve your financial goals and use bankruptcy protection to your advantage, our Mesa Bankruptcy Lawyers offer a FREE debt evaluation and consultation either in office or by phone. Our Mesa bankruptcy services understand the timing and planning of filing a bankruptcy in Mesa. The experienced Mesa Bankruptcy attorneys will discuss your options and advise you on your best course of action to eliminate your debt. If you are wondering if your medical debt, credit card debt, job loss, or overall situation would best be solved by bankruptcy, contact our law firm. Don’t forget… timing is important! Don’t hesitate to do something about your debt! We can help you get out of debt.

Loved The Communication!!

Pam T. – Mesa

“Definitely impressed by the communication factor they displayed.”

Give Them A Call!

Troy L. – Scottsdale

“I have already recommended them to three of my friends!”

My AZ Lawyers

Mesa, AZ 85202