Mesa Chapter 13 Bankruptcy Lawyer

Chapter 13 Bankruptcy Lawyers Serving Mesa, Arizona

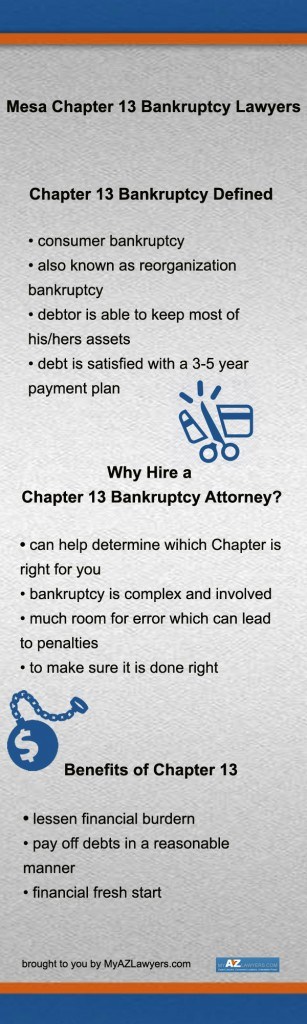

Chapter 13 Bankruptcy is slowly losing the stigma associated with it. Actually, it is now generally seen as a legit and effective way to manage debt and to find your financial footing again. After all, bankruptcy laws were put in place to help those that are overwhelmed by debt and financial obligations. Thus, if you are a Mesa resident and feel overwhelmed by debt, contact our Mesa Chapter 13 bankruptcy attorneys today. Also, we can help you determine which Chapter of bankruptcy is right for your individual case and devise a plan to give you the fresh start, you deserve.

What is a Mesa Chapter 13 Bankruptcy?

A Chapter 13 Bankruptcy is a reorganization of your debts. They will be spread out in a payment plan that lasts 3-5 years. If you have any arrearages on your mortgage or other loans, a Chapter 13 gives you the chance to catch up gradually.

How does a Chapter 13 Bankruptcy work?

Your payment plan will be determined using your income, reasonable expenses for your family size, and the amount of debt. Any outstanding balance on your vehicles, a fee for the trustee, your arrearages, your attorney’s fees, and a portion of your unsecured debts will be included.

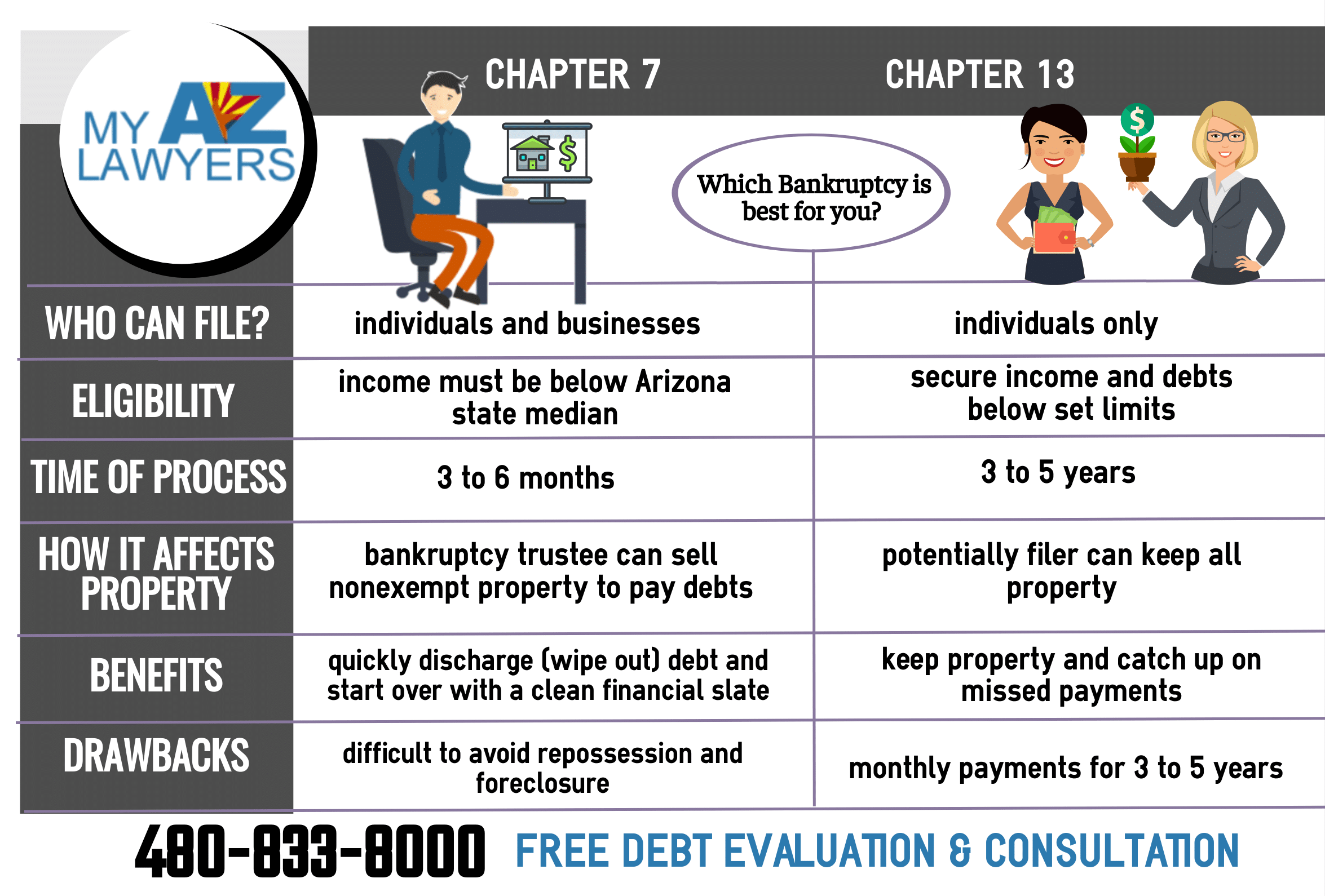

After we have determined (by way of the Means Test) which bankruptcy chapter is right for you, we will sit down and give you all the information you need to be prepared for the Chapter 13 bankruptcy proceeding. Chapter 13 is also known as the reorganization bankruptcy, because instead of selling off most of your assets in order to satisfy creditors, you may be able to keep most of those and pay of your creditors with a payment plan that uses your income and generally runs for 3 or 5 years.

Our Mesa Chapter 13 Bankruptcy Team

Our team of experienced Mesa Chapter 13 bankruptcy lawyers is here to help you and your family to get a fresh start in life. Being overwhelmed by debt can be scary and discouraging, but meeting with a bankruptcy lawyer and deciding on the best course of action bring peace of mind to many of our clients.

Additionally, we have been helping individuals who were in financial distress for many years and have assisted them to rehabilitate their finances with a Chapter 13 Bankruptcy filing. While you can file for Chapter 13 without legal representation, we want to point out that the bankruptcy process is complex and very involved and to assure that nothing goes overlooked, hiring a bankruptcy lawyer is an additional expense that is absolutely worth it. Here at My AZ Lawyers we’ll help you to make the most of your Chapter 13!

Free Bankruptcy Consultation With Experienced Attorney

To start you out right, we offer free Mesa Bankruptcy Consultations. During the consultation, we will look at your financial situation, apply the means test to see if and for which type of bankruptcy you qualify and then devise a strategy to get your finances back in order. As soon as you file for Chapter 13, you prevent your wages for being garnished and your car cannot be repossessed as well. You are even safe from home foreclosure. You may even qualify for a cramdown, which may give you lower interest rates on your home or car and thus increases your chance of being able to keep both. Additionally, it is stipulated that you complete credit counseling when filing for bankruptcy. If you cannot afford credit counseling services, certain agencies offer it for free or at a reduced rate. Contact our Mesa bankruptcy attorneys for a free consultation and case evaluation.

Why Wait? Get Debt Relief! Contact Us Today!

Don’t wait. Remember, you do not have to live with a financial burden that keeps you up at night. Thus, if you are unable to keep up with your monthly bills and financial obligations, contact your Mesa Chapter 13 Bankruptcy Attorney today. Plus, we can assist you during this difficult time and help you to restructure your financial future, a future free of suffocating debts and overwhelming bills. whereas, meeting with a local Mesa bankruptcy attorney you get the ball rolling and take charge of your financial reboot. You don’t have to do this on your own. Because, our compassionate and capable bankruptcy lawyers will explain the ins and outs of a Chapter 13 bankruptcy to you. Thus, how much involvement on your part is necessary (you may have to attend debtor meetings, for example), and how everything moves through the system. Get yourself the financial fresh start, you deserve.

ARIZONA CHAPTER 13 BANKRUPTCY ATTORNEY

CHAPTER 13 FREQUENTLY ASKED QUESTIONS

Our Mesa Chapter 13 Bankruptcy Attorneys discuss some of the most asked questions regarding Chapter 13 bankruptcy filings in Mesa, Arizona. Our experienced AZ BK Lawyers can assist you in keeping your home, avoiding a repossession, and stopping a wage garnishment through an AZ Chapter 13 bankruptcy filing.

Chapter 13 bankruptcy is an option of bankruptcy designed to permit a debtor in Mesa or Maricopa County keep assets of value. Ch 13 allows for a plan to repay creditors over a period of time. Our Mesa bankruptcy team can help you establish your Chapter 13 bankruptcy filing and will assist you setting up the Chapter 13 repayment plan with the bankruptcy trustee. During the course of the payment plan, the debtor is protected from garnishments, creditor lawsuits, or other actions.

My AZ Chapter 13 Bankruptcy Lawyers

My AZ Lawyers has the team to assist you with your Mesa bankruptcy. Our Mesa Chapter 13 bankruptcy lawyer can assist you in saving your home through declaring bankruptcy in Mesa. Thus, no matter if you are looking to file Chapter 7 or 13, we can advise you the best course of action and ensure that your bankruptcy will be done and handled right. Contact our office for a free bankruptcy consultation today. Additionally, we offer great payment plans and competitive prices.

Other services we offer are family and divorce law services, as well as DUI and criminal defense representation. We strive to offer our clients convenient and affordable legal services. To see how we can help you, call us today.

Call our Mesa Chapter 13 bankruptcy lawyer office today to receive a free consultation, or fill out the contact form below to get in touch with our team of Mesa bankruptcy law professionals.

My AZ Lawyers

Mesa, AZ 85202