Bankruptcy Services in Avondale

Avondale Zero Down Bankruptcy Attorneys

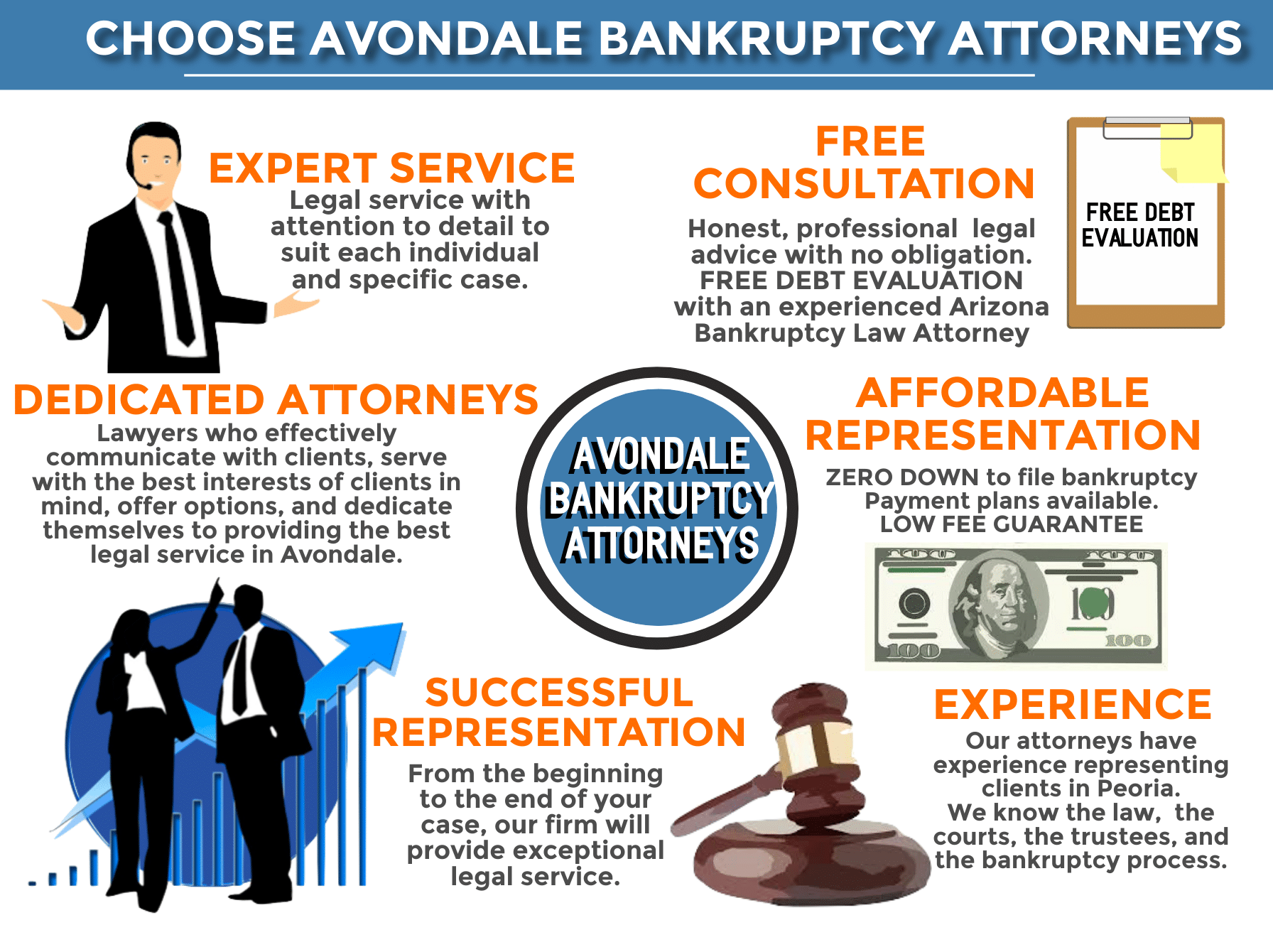

After you have tried everything to get out from under your debt burden, you may feel frustrated, worried and confused. At My Arizona Lawyers, PLLC, our Avondale Bankruptcy Team invite you to come in and meet with us about bankruptcy and other debt relief options that you may not have considered.

Avondale Bankruptcy Attorney

Call Our Bankruptcy Lawyers in Avondale, Arizona

Avondale is a relatively small community outside Phoenix. While that proximity opens up many career opportunities for commuters, the city itself doesn’t offer much in the way of industry. Thus, many residents have found themselves struggling in recent years as the economy has suffered a recent downturn. Additionally, these people are often in need of debt relief to stop a garnishment, save their homes from foreclosure, and get relief from nuisance creditors.

Avondale Lawyers for Chapter 7 and Chapter 13 Bankruptcy

Thus, if you are one of the many struggling with finances and debt, the team of Avondale bankruptcy attorneys at My Arizona Lawyers may be able

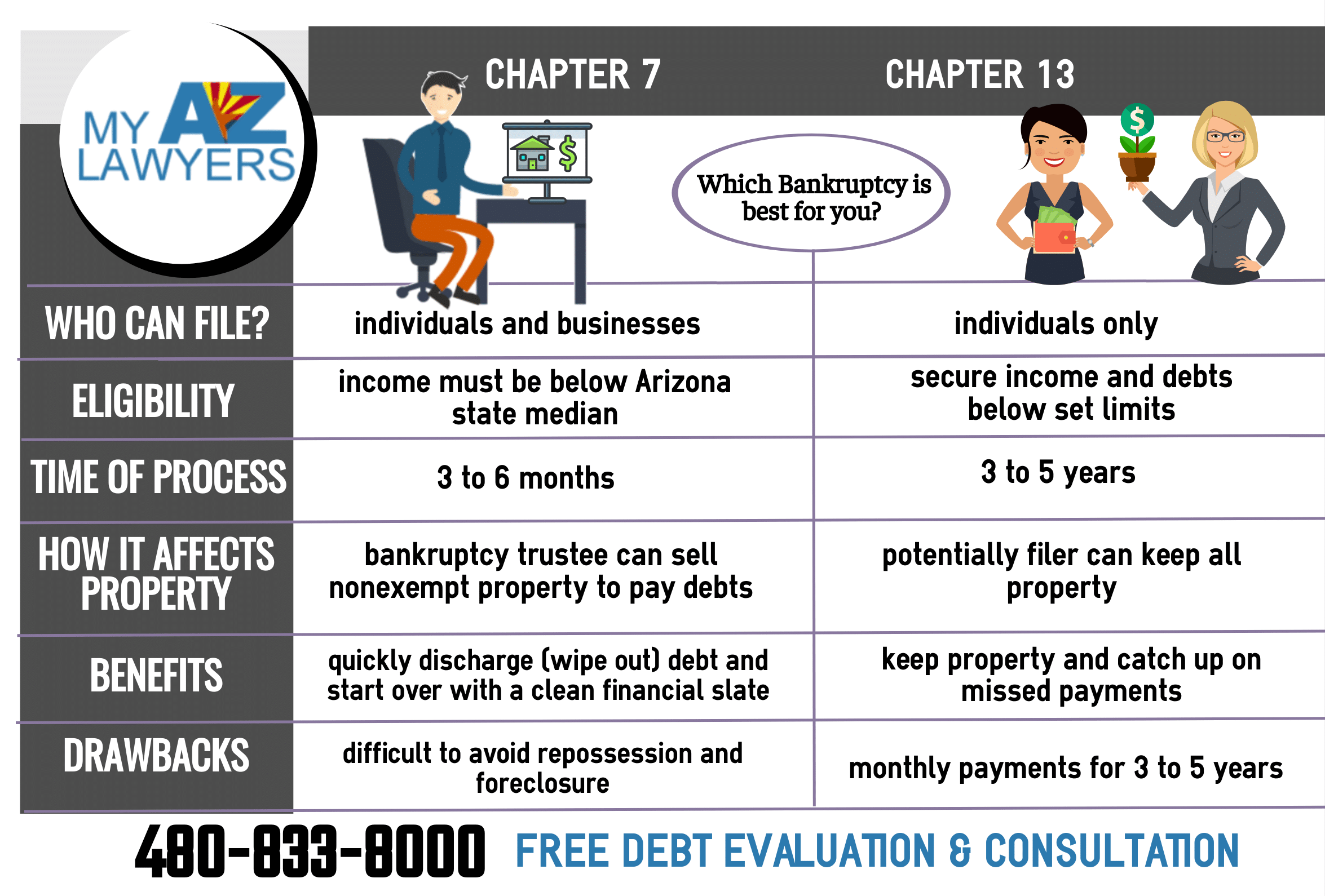

Furthermore, our Avondale bankruptcy attorneys and lawyers are able to help you whether you are interested in Chapter 7 bankruptcy or Chapter 13 bankruptcy. Additionally, Chapter 7 is the type of bankruptcy most people think about when they think about bankruptcy. Basically, straight forward alleviation of your debt.

Thus, declaring bankruptcy in Goodyear and Avondale offers you the potential to discharge of all your unsecured debts, such as your credit cards or medical bills. Plus, Chapter 13 bankruptcy in Avondale offers you the opportunity to restructure your debt so that you can reduce your overall interest charges and pay one smaller monthly payment. Furthermore, for those people struggling to make ends meet, our Avondale bankruptcy attorneys offer payment plans for every budget.

Plus, our Avondale bankruptcy law firm is an experienced group of bankruptcy lawyers and paralegals with a desire to help people with debt relief. Therefore, our attorneys want you and your family to get a “Fresh Start“. Isn’t it time that you live debt free?

Our Avondale Bankruptcy Team

Our legal professionals in profession can go over your financial circumstances and help you understand the best options for meeting your goals. Therefore, many people are hesitant to file for bankruptcy because of the stigma they think is attached to it or because of fear of financial issues related to it in the future. However, bankruptcy offers specific rights under the law for those in need, and it can actually create more financial opportunities by freeing you from the burden of debt.

Because the bankruptcy lawyers at My AZ Lawyers have the experience, training, and expertise in Avondale Bankruptcy Law, we can advise you on the best course action for your particular circumstances. Thus, our Avondale bankruptcy lawyer can help you get debt relief. Furthermore, our Avondale bankruptcy team will see you through the entire bankruptcy or debt relief process, beginning with your FREE debt evaluation. Plus, our Avondale debt relief team takes pride on helping you rebuild your financial future after a discharge. Let us help you with paperwork, court appearances, and advice.

If you live in Avondale and are struggling with debt, call My AZ Lawyers, our Avondale bankruptcy attorneys will explain how a bankruptcy lawyer may be able to help you. Some of the debt relief options that we offer the residents of Avondale for convenience include: Bankruptcy By Phone, Zero Down Bankruptcy, Chapter 7 Bankruptcy, Chapter 13 Bankruptcy, and emergency bankruptcy filings. Our experienced and friendly teams is ready to help you find the solutions you need to take back your financial future.

Avondale Chapter 7 Bankruptcy Lawyers

Avondale Chapter 13 Bankruptcy Attorney

Zero Down Avondale Bankruptcy

Under current bankruptcy laws in Arizona, you must pass a means test before filing Chapter 7 bankruptcy in Avondale. Therefore, if your current monthly income is below the Arizona adjusted median income, then you automatically qualify. However, even if your income is above the Arizona adjusted median income, you may still qualify, after expenses such as retirement contributions and car payments are deducted from your income. Our lawyers have helped many people file Chapter 7 bankruptcy after other attorneys told them that they did not qualify. We have filed thousands of successful Arizona bankruptcies.

Chapter 13 bankruptcy is often used by people in Avondale who are behind on their mortgage and want to save their home from foreclosure. Filing Chapter 13 in Avondale provides an opportunity to get out of debt by completing a repayment plan over a three-to-five year period. Another great use of Chapter 13 is to use it when you can not pass the means test for Chapter 7 bankruptcy. It also protects assets that may have been lost in a Ch 7. We will explain your options for loan modifications versus bankruptcy and the prospects of reaffirming secured debts. Contact our Avondale Chapter 13 Bankruptcy Lawyers today.

Our Avondale Zero Down Bankruptcy Law Firm offers a FREE no obligation, case evaluation and consultation with an experienced Avondale bankruptcy attorney. Residents in Avondale and Goodyear, Arizona trust our experienced and competent attorneys and legal staff. Our $0 down firm can file most bankruptcy petitions in Avondale with no money down. Thus, with no out-of-pocket expense for you, you can start a bankruptcy today. Whatever reason for your overwhelming debt, we are not here to judge. We are here to provide you with options to eliminate debt from your life with no money down.

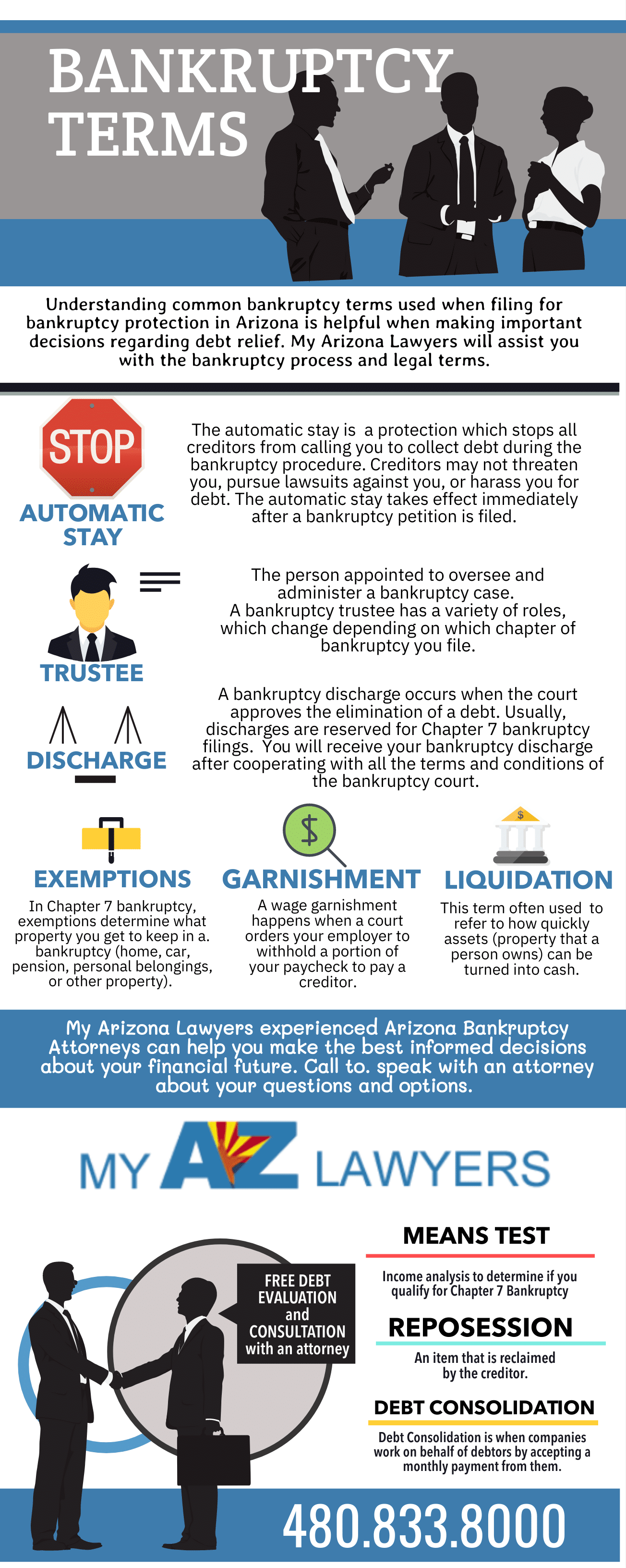

COMMON BANKRUPTCY TERMS

Common Bankruptcy Terms

Bankruptcy

A legal procedure that allows debtors to reorganize or liquidate their debt with court protection of their assets and properties in the process. Bankruptcy protects its filers from repossession, foreclosure, and garnishment while wiping filers’ financial slates clean.

Creditor

Someone who is owed money. It is usually someone who lends you money, but you may also owe for debts like child support and taxes.

Debtor

Someone who owes money to creditors.

Chapter 7 Bankruptcy

A liquidation of unsecured nonpriority debts. Examples of such debts are credit cards, medical bills, personal loans, past-due bills (for canceled services), and payday loans. There are strict income requirements to qualify for Chapter 7 Bankruptcy. You must make less than the median income level for your state, or pass the Means Test.

Chapter 13 Bankruptcy

A debt reorganization and repayment plan. Your plan will be 3-5 years long, depending on where you fall on your state’s median income level. Remaining debts at the end of the plan are discharged.

Bankruptcy Trustee

A court-appointed attorney who will serve as a referee in your bankruptcy case. They will analyze your petition and accompanying documents to make sure everything you have presented is truthful. If any of your assets are non-exempt or you made any preferential payments, they will force collection and contribute the excess to your bankruptcy estate. In a Chapter 13, your plan payments will be made to the trustee.

341 Meeting of Creditors

This is a mandatory hearing for both Chapter 7 and Chapter 13 bankruptcy filers. Your creditors will have the option to attend this hearing to ask questions about your bankruptcy and object to their debts being included.

Bankruptcy Discharge

When a bankruptcy case is discharged, this means it has successfully been completed. A Chapter 7 Bankruptcy is eligible for discharge 60 days after the 341 Meeting of Creditors, or typically 3-5 months from the date of filing. A Chapter 13 won’t be discharged until the payment plan Is completed, or 3-5 years from the filing date.

Means Test

This is the alternative method bankruptcy filers can use to qualify for Chapter 7 if their income is above their state’s median level for their family size. Mandatory expenses will be deducted from the average of your last six months’ income to determine if you have enough disposable income to pay your debts.

Non-Dischargeable Debt

This is a debt that you will still be liable for after your bankruptcy. Examples include student loans and child support.

Motion from Relief from Stay

Creditors who were about to foreclose on a home, repossess a vehicle, or garnish wages or a bank account can file this motion to proceed with collection in spite of the Automatic Stay of Protection.

Adversary Proceeding

A separate procedure inside of your bankruptcy when your creditors object to their debts being discharged.

Conduit Case

A Chapter 13 Bankruptcy in which the filer is behind on their mortgage payments. The past-due amount will be spread out over the course of the payment plan, which will be 3-5 years long.

Foreclosure

A forced home sale by a home loan lender when the homeowner has missed too many mortgage payments.

Repossession

A repossession occurs when a lender of a financed asset takes it back due to a violation of the contract, usually nonpayment.

Wage Garnishment

A method of debt collection that creditors who have obtained a judgment against you can use. A standard wage garnishment is 25% of your pay.

Great Experience!

James N. – Avondale

"They are hardworking, trustworthy, and efficient.”

Wow!

Ann S. – Avondale

“They gave my mother and my family the peace of mind we needed!”

My AZ Lawyers

Avondale, AZ 85392