Tucson Zero Down Bankruptcy Attorneys

I know what you’re thinking… Is This Really a $0 Down Bankruptcy Filing?

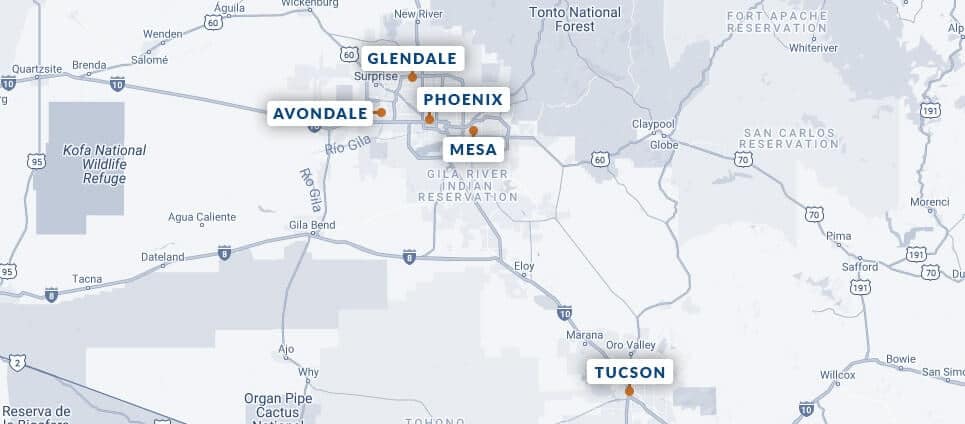

We have handled Arizona Bankruptcy for over a decade. Our Tucson bankruptcy lawyers offer sound guidance for individuals and small businesses who are devastated by unpaid debts and other financial obstacles. Therefore, the first step toward finding a solution to your financial troubles is contacting My AZ Lawyers and discussing your situation with a Tucson bankruptcy lawyer.

Call (520) 779-0777 now to make sure to qualify.

Do you need financing?

Instant Approval Available Apply Now

How Our Top Rated Tucson Bankruptcy Lawyers Can Help You

A petitioner filing Chapter 13 Bankruptcy in Tucson reorganizes debt and develops a debt repayment plan. In addition, the Ch 13 BK case is overseen by a bankruptcy trustee. Given these points, Chapter 13 bankruptcy is beneficial for Tucson, Arizona residents who do not qualify for Chapter 7, or who wish to keep all of most of their property. Zero Money down for a fresh financial start.

Bankruptcy Services Tucson may become necessary as Tucson is a thriving city that has experienced steady growth thanks to employers like the University of Arizona and the local government. Yet, there have been lean times for a lot of workers in industries outside of those mainstays. Some individuals were furloughed or laid off and others were unable to find work in comparison to their qualifications. Therefore, these individuals in Pima County are having to settle for lower-paying jobs. Thus, some may have relied more heavily on their credit during those times, while others may have simply allowed certain bills to go unpaid. All of these things are practices that lead to a rocky financial path.

Additionally, even good people can fall behind. For example, even the most responsible people can run into trouble financially. Therefore, bankruptcy provides the option for debt relief that some people need. Given these points, consider Tucson bankruptcy services when facing the possibility of declaring bankruptcy in Tucson.

In particular, our Tucson bankruptcy attorneys have the experience and knowledge that will benefit you greatly. Consider hiring our low cost bankruptcy services Tucson. Call us now at (520) 779-0777 for a free consultation either by phone or in our downtown Tucson bankruptcy office. Bankruptcy Services Tucson, we strive to make you debt free.

CLIENT REVIEWS & TESTIMONIALS

Natasha Lenard

🟊🟊🟊🟊🟊

Adam Walsh

🟊🟊🟊🟊🟊

Alexandra Ortiz

🟊🟊🟊🟊🟊

Awards &

Associations

Zero Down Bankruptcy Is Still A Complex Legal Procedure

What’s the catch? How are you able to offer this? YES, THIS IS REAL! Here is how it works; First, a “skeleton” bankruptcy filing is filed for you at no charge. Next, our bankruptcy services Tucson file the second part of your bankruptcy petition. Our Tucson bankruptcy firm charges for the 2nd part of your bankruptcy filing. However, you don’t have to start paying for your bankruptcy until 30 days after you file. Then, you make simple monthly payments to pay off your bankruptcy. Keep in mind, even a “simple” Chapter 7 bankruptcy in Tucson is still a complex legal procedure that takes place in the federal courts. Bankruptcy services Tucson believe that you should not try to file for bankruptcy protection without the assistance of an experienced lawyer. Thus, our simplified “Zero Down BK” process makes it possible for people who may not be able to afford a bankruptcy attorney, now they have an option.

TUCSON CHAPTER 7 BANKRUPTCY LAWYERS

Chapter 7 bankruptcy is the most common bankruptcy filing in Tucson. Another key point, Arizona Chapter 7 bankruptcy protection allows debtors to keep exempt and essential assets while eliminating dischargeable debt. Also, a bankruptcy means test indicates who is eligible to file Chapter 7. Our experienced Chapter 7 bankruptcy attorneys can help you get out of debt.

$0 DOWN BANKRUPTCY IN TUCSON, ARIZONA

Considering filing bankruptcy? Call us about the zero down bankruptcy program. Especially, if your decision includes needing a bankruptcy attorney, but you don’t know how to pay the legal fees up front (which bankruptcy filing requires). Also, if you cannot afford to pay legal fees up front, be sure to call our Tucson Bankruptcy Lawyers (520) 779-0777 find out if you qualify for the $0 down program.

Bankruptcy Courts in Arizona

A United States bankruptcy judge presides over the bankruptcy cases. This judge has the power to make decisions over all matters concerning federal bankruptcy cases. For each judicial district in Arizona, there is a bankruptcy court. In Arizona, the bankruptcy courts are located in:

Tucson

US BANKRUPTCY

COURT

38 S Scott Ave,

Suite #900-6A

Tucson, AZ 85701

Yuma

US BANKRUPTCY

COURT

98 West 1st Street,

2nd Floor,

Yuma, AZ 85364

Flagstaff

US MAGISTRATE

COURTROOM

123 North

San Francisco Street,

Flagstaff, AZ 86001

Bullhead City

MOHAVE COUNTY

SUPERIOR COURT

2225 Trane Road,

Courtroom R,

Bullhead City, AZ 86442

TUCSON BANKRUPTCY LAWYERS

Payment Plan Options to file Bankruptcy in Tucson – File Now Pay Later!

Tucson Bankruptcy Services

What Is It? Bankruptcy Code Explained

Arizona bankruptcy laws offer certain protections to debtors who are needing to eliminate debt through reorganization or liquidation. Thus, the bankruptcy code, called Title 11 of the United States Code, details these procedures. Furthermore, the bankruptcy code is a uniform federal law that oversees all bankruptcy cases. In addition, it has been amended several times since it’s original completion. In fact, the filing of most bankruptcies in the bankruptcy code fall under Chapter 7, Chapter 11, and Chapter 13. Also, when filing for bankruptcy it must occur in a federal bankruptcy court (not a state court). In fact, the bankruptcy law’s main purpose is to give a debtor a fresh start. In providing a fresh start, a bankruptcy relieves the debtor of most debts and/or the debtor pays creditors back through available properties that can be used for payment.

ARIZONA BANKRUPTCY CODE

Understanding bankruptcy is an important step to determining if bankruptcy is the right choice to eliminate your debt, and it can help you decide which chapter to file. For example, when individuals or businesses owe more debt than they can pay, bankruptcy laws and rules assist with debt relief. The filing of bankruptcy cases occurs in a bankruptcy court; a federal court. In addition, the federal laws that govern bankruptcy cases allow for debtors to liquidate assets to pay debt, or create a repayment plan to reorganize debt and pay back creditors over time.

PROVISIONS OF THE BANKRUPTCY CODE

Under the provisions of the bankruptcy code, a bankruptcy trustee collects and sells any nonexempt assets and property. The trustee then uses these proceeds to pay creditors. The Bankruptcy Code outlines property exemptions. Certain exempt property may not be taken and sold by the trustee in a Chapter 7 bankruptcy. The trustee will liquidate any remaining assets that are not exempt. If you have any property that does not fall under the Arizona exemption law, you may lose this property in a Chapter 7 bankruptcy. Chapter 7 bankruptcy may not be the answer for debt relief for everyone. First of all, you need to qualify to file Chapter 7. Under the Bankruptcy Code, a person must pass a means test to be eligible.

Contact An Experienced Bankruptcy Attorney Today

Therefore, when you need to stop a wage garnishment, end harassing phone calls from creditors, or even stop a foreclosure, you need an experienced attorney to take action immediately. My Arizona Lawyers offers a $0 Down Bankruptcy program, so filing for bankruptcy requires zero money out of pocket. You pay zero money to wipe out debt. In other words, zero money takes back control of your life. Zero money down to stop the phone calls from creditors. Zero money down to end a Tucson wage garnishment. Plus, Zero money down to retain a Tucson bankruptcy attorney who is dedicated to protecting your rights as a debtor. Bottomline – zero money down gets you out of debt!

Disputes And Litigation In The Bankruptcy Court

Skilled Tucson Bankruptcy Attorneys Representing You In Court

When a bankruptcy petition is filed, creditors listed on the paperwork receive a notice from the court that a bankruptcy was filed by the debtor. Also, when a bankruptcy involves liquidation of property and assets, there may not be much money available to pay creditors. In these cases, normally the debtor is given a bankruptcy discharge. Therefore, if a discharge is granted, a debtor is no longer personally liable for repaying debt. Thus, it is possible for disputes to arise, and in some cases, litigation in the bankruptcy court – proceedings, settlement efforts, or a trial is necessary.

Tucson Bankruptcy Myths Uncovered

Myths and Truths Regarding Bankruptcy in Tucson, Arizona

The Tucson Bankruptcy Attorneys at My Arizona Lawyers realize that there are a myriad of reasons that people have to file for bankruptcy protection in Tucson. Therefore, the process of declaring bankruptcy in Pima County is complex. This is made even more difficult with the many myths and fallacies out there. In the following, our knowledgeable Pima County Bankruptcy Attorneys dispel common bankruptcy myths. Our Tucson debt relief lawyers tirelessly work to help individuals, couples, families, and businesses in Pima County file for bankruptcy protection.

Common Fallacies About Filing for Bankruptcy

Filing for Chapter 7 bankruptcy in Tucson, Arizona

The primary purpose of a Chapter 7 bankruptcy is to eliminate certain kinds of debt. The bankruptcy court must receive a case filing and administrative fees in order to file a bankruptcy petition. Next, a filer must complete official bankruptcy forms. These forms include the petition to file, schedules, and statement of debt/financial affairs. The filer should also include and provide the following paperwork:

One of the schedules the filer must file is that of exempt property. According to the Bankruptcy Code, some property is protected, or exempt, from creditors. However, Arizona has adopted its own exemption law. Filing a bankruptcy petition under Chapter 7 puts the automatic stay into effect immediately. The stay is effective to protect a debtor from collection activity from a creditor. Furthermore, the bankruptcy court appoints a trustee to administer the bankruptcy case, and to carry out the liquidation of the non-exempt assets.

Because of the complexity of the Bankruptcy Code, it is wise to consult with an attorney who can evaluate your debt, listen to your needs, and look at your property/assets.

CHAPTER 7 – BANKRUPTCY

Chapter 7 is the most common chapter of bankruptcy filed in Arizona. The bankruptcy laws and the Arizona bankruptcy code were designed to give Arizona residents a fresh start by eliminating debt. Chapter 7 bankruptcy is the most frequently filed because it allows debtors to keep exempt and essential assets and property while wiping out overwhelming, dischargeable debt.

If you are considering bankruptcy, you should understand the process, and explore all your options for the best method of debt relief. An attorney at My AZ Lawyers will not only guide you through the process from beginning to end, but also explain the different aspects of the law. Our experienced Arizona Bankruptcy attorneys will answer your questions and concerns and give you the information you need to successfully get you out of debt.

CHAPTER 7 – LIQUIDATION BANKRUPTCY

Chapter 7 bankruptcy is also known as a liquidation bankruptcy. This is a court-supervised process involving a trustee. The court appoints a trustee to take over the case. Furthermore, the trustee oversees the case by taking over assets, reducing them to cash (liquidating assets), and distributes owed debt to creditors. In many Chapter 7 cases, there are little or now nonexempt property and assets. This means there may not be any actual liquidation of assets. In the case of a no-asset bankruptcy, an individual will receive a discharge. A discharge is the release from all personal liability for dischargeable debts. In other words, the debt listed in the bankruptcy is forgiven, eliminated, or discharged.

CHAPTER 7 – BANKRUPTCY DISCHARGE

In a Chapter 7 bankruptcy in Arizona, which includes cases filed in Pima County and Tucson, certain types of debts can be discharged, providing individuals with a fresh start and relief from their financial burdens.

A Chapter 7 bankruptcy discharge can be granted in a few months after filing the petition. A bankruptcy discharge is a permanent order stating the debtor is no longer legally required to pay back debt listed in the case. Therefore, a discharge prohibits a creditor from taking action to collect on any debts that were eliminated in the bankruptcy. In addition, a creditor may not communicate in any way or take legal action to collect debt. The discharge is given in Chapter 7 cases approximately four months after the date of the petition filing. There is also an amount of time where a creditor can object to the discharge, and when this period ends without a motion to dismiss the case, the discharge is granted.

Additionally, a discharge is not automatically granted just because the process is completed. A creditor, a trustee may file an objection. Meaning, a creditor may file a complaint before a deadline date. The bankruptcy code describes the reasons a discharge may be denied. For example, not providing the proper documentation, failure to complete the required credit counseling / financial management course, or covering up property with intent to defraud. A Chapter 13 bankruptcy case is a bit different. Normally the debtor is entitled a discharge when the payments under the plan are completed.

Here are some examples of debts that can typically be discharged in a Chapter 7 bankruptcy:

1

Credit Card Debt:

Credit card balances, including outstanding charges and interest, are generally dischargeable in a Chapter 7 bankruptcy in Tucson, Arizona. A skilled Tucson Bankruptcy Attorney can help individuals navigate the process to eliminate these debts.

2

Medical Bills:

Unpaid medical bills, including hospital fees, doctor’s bills, and prescription expenses, are eligible for discharge, offering much-needed relief to those facing overwhelming healthcare-related debt in Pima County.

3

Personal Loans:

Many types of personal loans, such as unsecured personal loans from banks or online lenders, can be discharged in a Chapter 7 bankruptcy in Tucson. Your Tucson Bankruptcy Attorney can assess your specific situation and advise on which personal loans may be dischargeable.

4

Utility Bills:

Outstanding utility bills, including electricity, water, and gas bills, are generally considered unsecured debts and can be discharged through Chapter 7 bankruptcy, helping individuals regain control of their finances in Pima County.

5

Collection Accounts:

Debts that have been sent to collections agencies, including past-due rent, outstanding phone bills, and other unpaid obligations, can often be discharged, allowing individuals to put an end to creditor harassment.

6

Business Debts:

If a business owner in Tucson, Arizona, is personally liable for business-related debts, such as loans or credit lines, those debts can potentially be discharged in a Chapter 7 bankruptcy, protecting the individual’s personal assets.

7

Legal Judgments:

Certain civil judgments and court-ordered fines can be discharged in a Chapter 7 bankruptcy, preventing further legal actions or garnishments in Pima County.

8

Overdraft Fees:

Bank overdraft fees and related charges can be discharged, providing relief from the cycle of fees and debt accumulation for individuals in Tucson.

9

Payday Loans:

High-interest payday loans can often be discharged in bankruptcy, allowing individuals to break free from the cycle of debt associated with these loans.

10

Old Income Taxes:

Some income tax debts may be dischargeable in Chapter 7 bankruptcy, depending on factors such as the age of the tax debt and whether the taxpayer has met specific criteria. A knowledgeable Tucson Bankruptcy Attorney can help assess the dischargeability of tax debts.

It’s important to note that not all debts are dischargeable in Chapter 7 bankruptcy. Non-dischargeable debts typically include child support, alimony, certain tax debts, student loans (with exceptions), and debts arising from fraudulent or malicious actions. Consulting with a qualified Tucson Bankruptcy Attorney is essential to determine which debts can be discharged in your specific circumstances and to navigate the bankruptcy process effectively in Pima County or Tucson, Arizona.

Bankruptcy Petition And Automatic Stay

A bankruptcy case either involves liquidation of property, or establishes a plan to repay creditors. Typically, to begin a case, the debtor files a petition with the bankruptcy court. Statements are also filed that list liabilities, income, assets, the name(s) of creditor(s), and the amount of debt owed. One of the provisions of the bankruptcy law is the automatic stay. Thus, upon filing of a petition, all debt collection attempts must stop. Filing bankruptcy “stays,” or prevents debt collection actions by creditors for payment or property. Therefore, when the automatic stay is in effect, a creditor may not garnish wages, bring about or continue a lawsuit, or contact the debtor. This includes phone calls demanding payment or making harassing threats to get a payment.

Filing a bankruptcy petition puts the Automatic Stay into effect. This means you have the protection of the bankruptcy court as soon as your case is filed. Why is this important?

The Automatic Stay prevents any creditor from collecting on a debt:

- No collection attempts

- No phone calls from creditors

- Wage garnishment stops

- Lawsuits

- Stop a foreclosure

Because the Automatic Stay begins the moment the bankruptcy is filed, we understand that for some clients, an immediate filing is crucial. That’s why My Arizona Lawyers offers a $0 down program as well as payment plan options. We make eliminating debt through bankruptcy affordable and possible for debtors needing the bankruptcy protection of the Automatic Stay.

Discount Bankruptcy Services Tucson

Time is of the essence when deciding if you should file for bankruptcy. Many of your financial situations are already dire and pressing, there is no time to waste when you have made the decision to do something effective about it. Thus, our Tucson bankruptcy lawyers from our Tucson bankruptcy law firm can assist you in determining how to resolve your financial situation and protect your rights through affordable debt relief. Isn’t it time for a fresh start? The Tucson bankruptcy lawyers from My AZ Lawyers can provide you a new start at a fraction of the cost of other Tucson attorneys.

My AZ Lawyers Bankruptcy Attorney Can Help – Best Debt Relief Options

Working with a My AZ Lawyer bankruptcy attorney can help you determine which option will be best for you to get the debt relief you need while also protecting your assets. In addition, filing for bankruptcy is a complex process, and it is easy to make a mistake with the documentation if you attempt to handle it yourself or to use a document service. In particular, a Tucson lawyer can help you file the paperwork properly and to help you find all the opportunities to get the best debt management plan for your circumstances.

As a result, you should stop feeling like your financial circumstances are beyond your control. If you are struggling with debt, speak with My AZ Lawyers today for the best debt relief options in Tucson. The bankruptcy services Tucson can help. Call (520) 779-0777 for a FREE consultation.

5 Bankruptcy Warning Signs That Could Be Exacerbated by Holiday Spending

Struggling with holiday debt? Learn how filing bankruptcy in Arizona can help clear debt and regain control, especially when holiday spending causes stress

MY AZ LAWYERS TUCSON BANKRUPTCY

ATTORNEYS CAN HELP

Bankruptcy is a matter in which experience matters. My AZ Lawyers Tucson Bankruptcy attorneys have helped Arizona residents get out of debt and get the fresh start as detailed in the Federal Bankruptcy Code. The goal of the bankruptcy laws are to give debtors a clean slate — to erase debt in order to better get back on their feet. In this case, the goal of My AZ Lawyers is to use the power and protection of the US Bankruptcy Code and the Arizona bankruptcy law to provide the best possible legal representation for your bankruptcy case.

Tucson residents are no exception to the many Americans across the nation feeling the hurt of the economy, loss of job, or unexpected life tragedies that create debt that spirals out of control. If you are feeling anxiety, concern, stress, or fear about filing for bankruptcy, or even discussing your financial issues, no worries. Our team of debt relief experts will answer your questions and help you every step of the way. Filing for bankruptcy is a process that is somewhat complex. We will help you file the petition, complete the required paperwork, advise you of your options, and accompany you to the 341 court hearing. As well as, we will give you our best legal representation and advice so that you will feel comfortable, not stressed, about getting yourself on the road to a new beginning — debt free.