Contact our

Buckeye Bankruptcy Attorney

Find out how you might be able to get debt relief and start taking back control of your finances by calling My AZ Lawyers today. A Buckeye bankruptcy lawyer may be able to work with you to get you the clean slate that you need. Our office offers FREE evening and weekend consultations by appointment. Call and schedule a consult with our Buckeye bankruptcy services today.

Do you need financing?

Instant Approval Available Apply Now

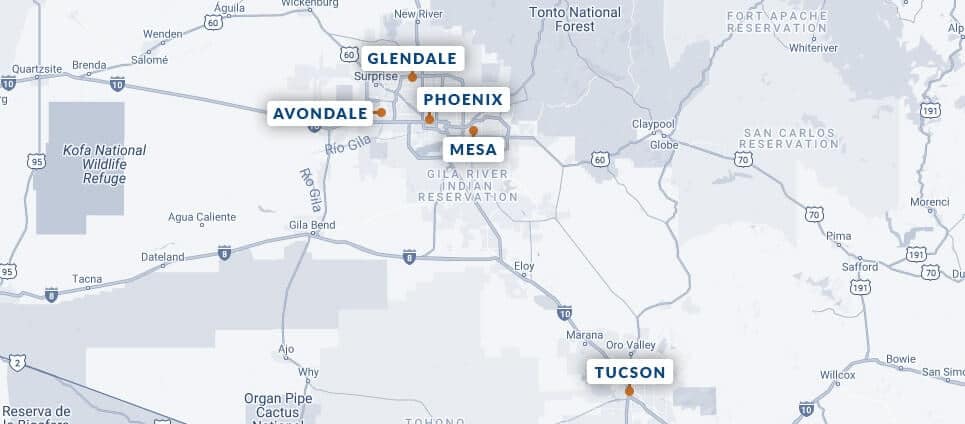

Bankruptcy Courts in Arizona

Tucson

US BANKRUPTCY

COURT

38 S Scott Ave,

Suite #900-6A

Tucson, AZ 85701

Yuma

US BANKRUPTCY

COURT

98 West 1st Street,

2nd Floor,

Yuma, AZ 85364

Flagstaff

US MAGISTRATE

COURTROOM

123 North

San Francisco Street,

Flagstaff, AZ 86001

Bullhead City

MOHAVE COUNTY

SUPERIOR COURT

2225 Trane Road,

Courtroom R,

Bullhead City, AZ 86442

Buckeye Bankruptcy Lawyer

Payment Plan Options to file Bankruptcy in Buckeye – File Now Pay Later!

Buckeye Bankruptcy Services

Our Buckeye Bankruptcy Team Can Help You File The Following Types Of Bankruptcies

Our Buckeye Bankruptcy Team

Our Buckeye bankruptcy lawyers will make sure that every document is filed completely and correctly. Therefore, by hiring a competent and experienced Maricopa County bankruptcy attorney, you can be sure that nothing goes overlooked. Bankruptcy can be stressful and intimidating, but by having appropriate legal counsel, you can relax and be certain that you are on the road to a brighter financial future. We understand the emotional toll debt and bankruptcy can have on our clients, which is why we work swiftly and efficiently so that you can get a good night’s sleep sooner.

Buckeye Chapter 7 Bankruptcy

A Buckeye Chapter 7 bankruptcy is also known as liquidation bankruptcy, because assets can and may be used to pay off your creditors. Therefore, if Chapter 7 bankruptcy is the right fit for you will be determined with the means test and during a consultation with our Mesa chapter 7 lawyers. Therefore, the moment our Buckeye bankruptcy lawyers file for Chapter 7 bankruptcy, an automatic stay will prevent all collection attempts from creditors. However, the length of this stay can vary. Therefore, consult your Buckeye bankruptcy attorney about the terms of a Chapter 7 bankruptcy and its implications in your personal financial situation.

Buckeye Chapter 13 Bankruptcy

A Buckeye Chapter 13 bankruptcy is also known as a reorganization bankruptcy, because your debts are reorganized by a payment plan that allows you to pay off your creditors over the course of three to five years with your monthly income. Unlike in a Chapter 7 bankruptcy, you will probably be able to keep most if not all of your assets as they are not used to satisfy the claims of your creditors. Additionally, Chapter 13 is a consumer bankruptcy that is designed to alleviate the financial burden that our clients carry with them while trying to keep up with their bills. Please contact our Buckeye Bankruptcy Services for additional assistance.

Client Reviews & Testimonials

Loved The Communication!

“Definitely impressed by the communication factor they displayed.”

Pam T. – Mesa

🟊🟊🟊🟊🟊

Give them a call!

“I have already recommended them to three of my friends!”

Troy L. – Scottsdale

🟊🟊🟊🟊🟊

“He’s Given Me The Power To Fight Back!

Thanks to Rob at My AZ Lawyers, I have the opportunity to stand up for my rights….and that’s priceless.”

Jacqueline C.

🟊🟊🟊🟊🟊

Buckeye Bankruptcy Myths Uncovered

Myths and Truths Regarding Bankruptcy In Buckeye, AZ

Common Fallacies About Filing for Bankruptcy

There are many misconceptions and common misunderstandings surrounding bankruptcy, which can cause people to miss a financial opportunity simply because they have the wrong information. The process is complex and requires skilled legal guidance, but having Buckeye bankruptcy lawyers available to answer all your questions and set the record straight can make all the difference.

Buckeye Bankruptcy Law Firm Helping You Overcome Debt

Though you technically can file for bankruptcy yourself, it is not recommended. Filing for bankruptcy can actually be a complicated process, and failing to get all the details just right can result in severe penalties. By working with a bankruptcy lawyer, you can ensure that all the paperwork is filed appropriately, and that you are taking advantage of all the opportunities that bankruptcy affords you, such as the possibility of keeping certain assets.

Chapter 7 – Liquidation Bankruptcy

Liquidation bankruptcy is simply another term used for a Chapter 7. As a court-supervised process, liquidation bankruptcy involves a trustee who takes over your assets, liquidates them, and distributes the cash earned to your debtors. Remember that only dischargeable debts are erased.

Chapter 7 – Bankruptcy Discharge

A few months after filing your Chapter 7 bankruptcy, you will be granted a bankruptcy discharge. This is a permanent order stating that you are freed from paying back dischargeable debt listed in the bankruptcy case. My AZ Lawyers will communicate this order with you.

Buckeye Chapter 13 Bankruptcy Attorneys

In a Chapter 13 bankruptcy, your debt is reorganized into a more manageable payment program, spread out over the next 3-5 years. This allows the flexibility to face the overwhelming debt while stopping foreclosure or other imminent concerns. Contact My AZ Lawyers to learn more.

Buckeye Chapter 7 Bankruptcy Lawwyers

Our Buckeye bankruptcy attorneys at My AZ Lawyers are highly experienced with helping clients file a Chapter 7 or Chapter 13 bankruptcy. Because a Chapter 7 is the most commonly filed type, we know how to help you through the process with professionalism, empathy, and strategy. We know you did not purposely get caught in a mountain of debt, so we are here to do everything we can to help you deal with it and move toward financial freedom.

When filing a Chapter 7 bankruptcy, you must give the bankruptcy court a case filing and pay all the administrative fees up front. The forms are then filed by your lawyer, including the petition to file, payment schedule, and financial statement. It is important to remember that some debts are non dischargeable and cannot be erased in a Chapter 7, including student loan payments and child support. However, wage garnishment and other attempts from debtors to collect what is owed are immediately ended. Call My AZ Lawyers today to learn more!

Discount Bankruptcy Services Buckeye

My AZ Lawyers Bankruptcy Attorney Can Help – Best Debt Relief Options

Forget what you think you know about bankruptcy and contact our Buckeye bankruptcy team today. We can help you to find peace of mind and assist you in taking charge of your financial future. Put an end to sleepless nights and days of endless worry and meet with a bankruptcy attorney today. Bankruptcy laws are put in place to give people struggling with debts a helping hand and to take away the shadow of debt that is hovering over them. Take the first step today, you will be glad you did.

Arizona Family Law Issues & Cohabitating Co-Parents

Struggling with Arizona family law issues? Discover how cohabitating co-parents navigate child support, custody, divorce, and more. Call for a free consult.

Buckeye Bankruptcy Team Can Help

Bankruptcy Attorneys in Buckeye, AZ

If you’re in Buckeye or southwest Phoenix and facing overwhelming financial debts and obligations, declaring bankruptcy may be the best way to regain control over your finances. Plus, declaring bankruptcy in Buckeye will get you a “Fresh Start” and possibly some peace of mind. However, filing Chapter 7 or Chapter 13 bankruptcy is a consequential decision. Additionally, bankruptcy can have dramatic long-term implications, even if it is a necessary debt relief step to take in the short term.

Seeking guidance from a Buckeye bankruptcy lawyer is a great way to determine if bankruptcy is right for you. Plus, assistance from a knowledgeable attorney from our Buckeye Bankruptcy Services ensures you obey all the rules and regulations associated with your bankruptcy. Plus, having our Maricopa County Debt Relief Team on your side increases your chances of achieving the new financial beginning that you seek.

Awards &

Associations

Buckeye Bankruptcy FAQs

Our Buckeye LEGAL Services

slip and fall accidents

After a slip and fall accident, the physical pain and mental trauma may be serious. As victims recover from injury, they often take on added stress because of medical bills and lost wages. Our personal injury and accident attorneys are experienced in representing slip and fall cases.